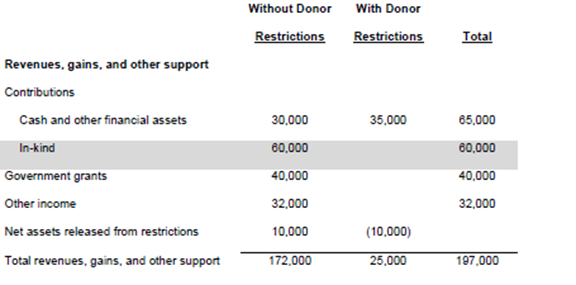

In-Kind Donations Accounting and Reporting for Nonprofits

Even though in-kind gifts are a major source of support for many nonprofits, recording and reporting them properly can present some unique challenges.

Nonprofits: Understanding In-Kind Gifts

Beginner's Guide to Nonprofit Accounting

In-Kind Donations Accounting and Reporting for Nonprofits

How to Improve Working Capital in Manufacturing Operations

A Roadmap to Hiring a CFO

FASB Changes Rules For Gifts-In-Kind Disclosures - The NonProfit Times

Tracking In-Kind Donations for Businesses & Nonprofits — DonationMatch

In-Kind Donations for Nonprofits: Reporting and Accounting

How to Create a 501(c)(3) Tax-Compliant Donation Receipt - Donorbox

CFO Selections

Tracking In-Kind Donations for Businesses & Nonprofits — DonationMatch

In-Kind Donations: The Ultimate Guide + How to Get Started

In-Kind Donations: New Requirements and a Refresher on Existing

:max_bytes(150000):strip_icc()/Non-profitorganization_final-318d87a364914361afa52c3aab3f92dc.png)

Nonprofit Organization (NPO): Definition and Example

CFO Selections on LinkedIn: CFO Selections Recognized as an Oregon