Australian Government Bonds - Bond Adviser

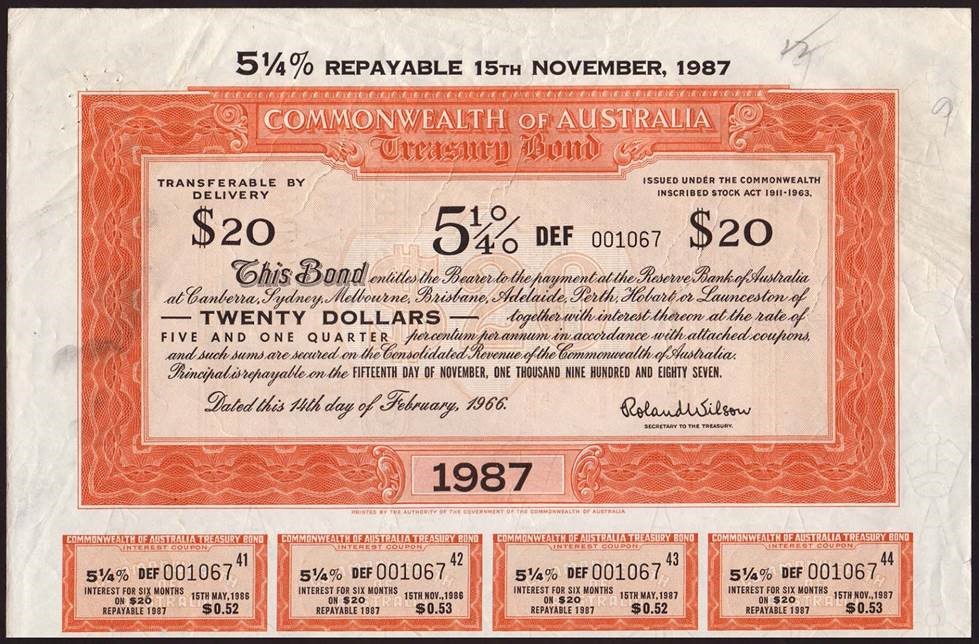

Commonwealth Government Bonds (CGS) are medium to long term debt issued by the Treasury through the Australian Office of Financial Management (AOFM). These securities pay a fixed coupon semi-annual in arrears, which are redeemable at face value on the specified maturity date and are the most liquid fixed income security in the Australian. Bonds issued

Government Bonds: What to Know and How to Invest

Exchange-traded Australian Government Bonds

File:Letter from Wayne Collins, attorney for the defense, to Tom DeWolfe, Special Assistant to the Attorney General, et al. - NARA - 296670.jpg - Wikipedia

What is a bond?

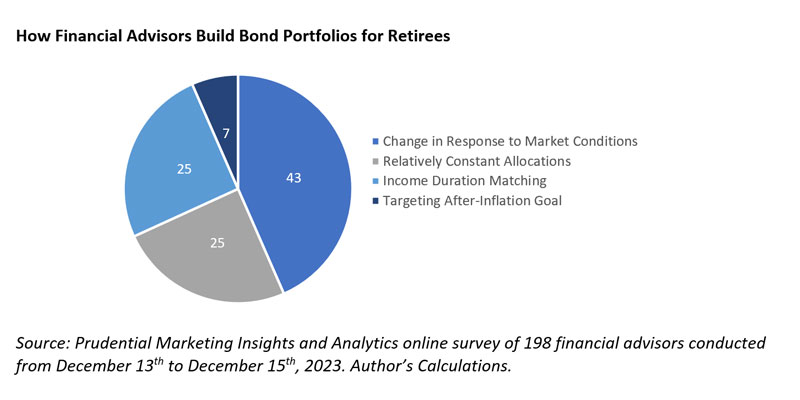

How Advisors Build Retirement Income Portfolios, in 7 Charts

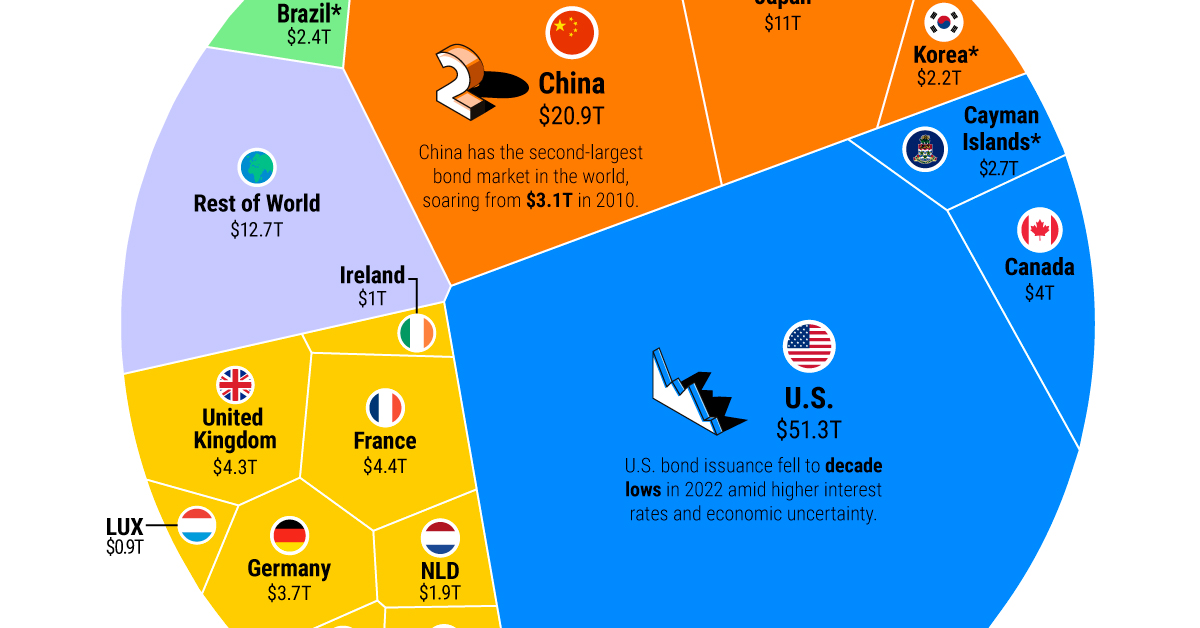

Ranked: The Largest Bond Markets in the World

How ETF bond ladders can help give client portfolios a boost

A rare municipal bond opportunity: Equity-like yields

Semi Government Bonds - Bond Adviser

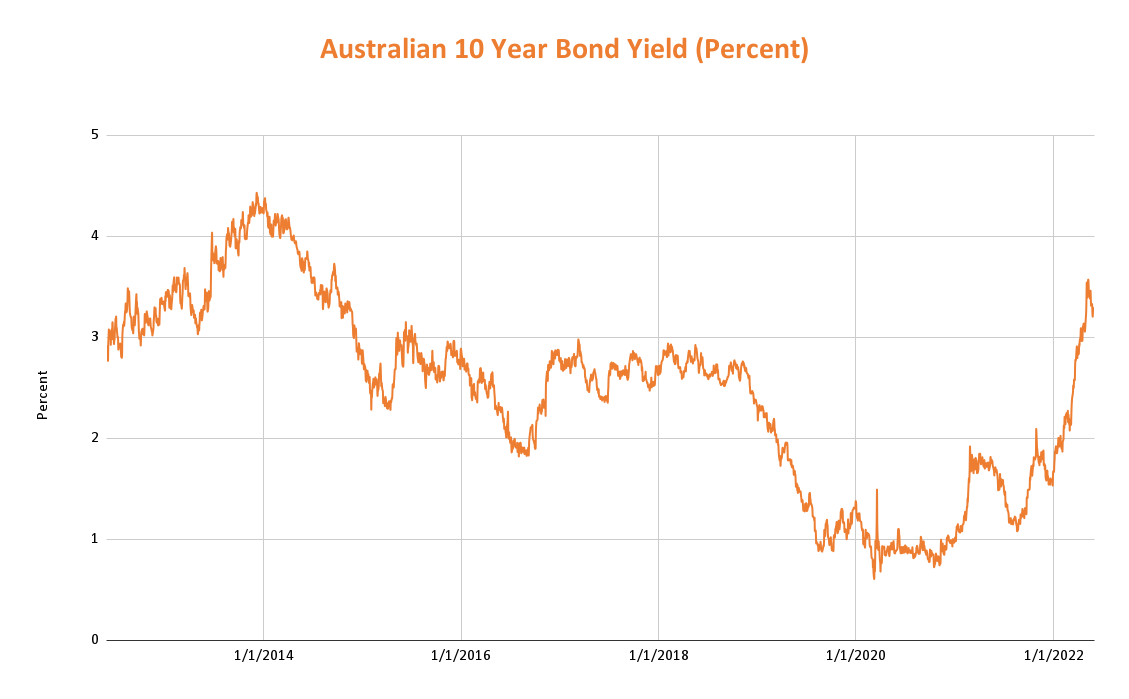

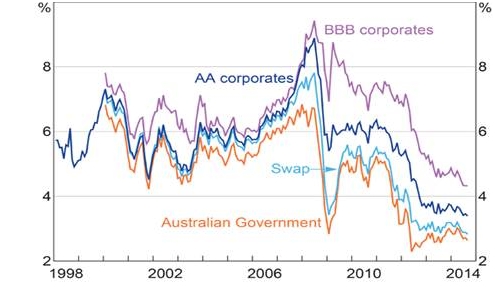

Record low yields on Australian corporate bonds – but what about credit spread levels?

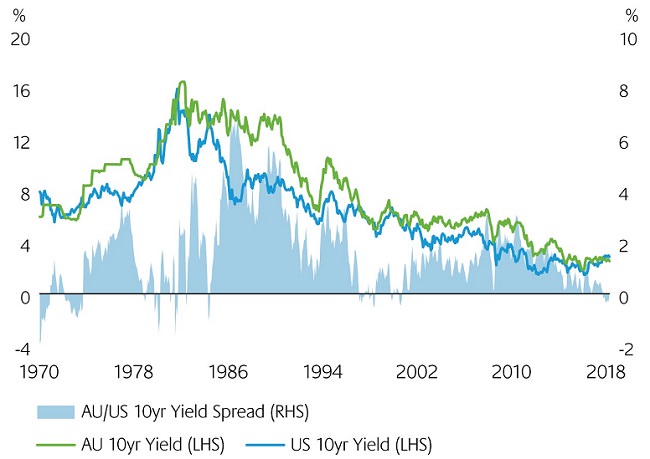

The impact of negative Australian versus US rate spreads

Global Credit: An Introduction

What Are Bonds and How Do They Work? - Ticker Tape

The Sharma Group, Financial Advisors in Boston, MA 02110