Building the Case: Low-Income Housing Tax Credits and Health

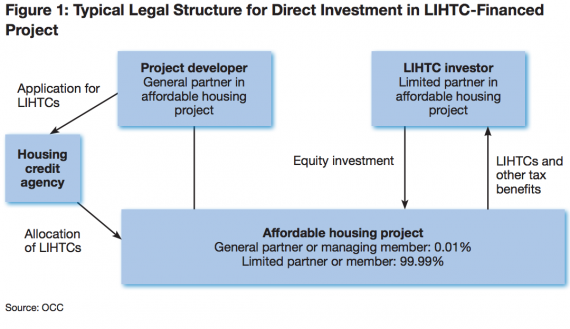

The Low-Income Housing Tax Credit (LIHTC) provides tax credits to private investors to support the development of affordable, multifamily housing. Since its inception, the…

Building the Case: Low-Income Housing Tax Credits and Health - TAAHP - Texas Affiliation of Affordable Housing Providers %

Exploring Tax Policy to Advance Population Health, Health Equity, and Economic Prosperity: Proceedings of a Workshop - in Brief

Housing Matters Policy Update: 11-29-17 – North Carolina Housing Coalition

What is Low-Income Housing Tax Credit?

The 30-year clock is running out on affordable housing

What Is the Low Income Housing Tax Credit?

Low Income Housing Tax Credit, Affordable Housing NYC

HUD-HHS Partnerships Bipartisan Policy Center

What Is the Low Income Housing Tax Credit?

Affordable Housing” Schemes Fail Because They Don't Advocate for

Understanding and Addressing Racial and Ethnic Disparities In Housing