Low-Income Housing Tax Credit Could Do More to Expand Opportunity

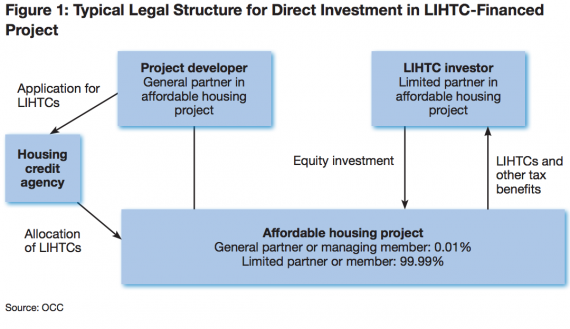

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

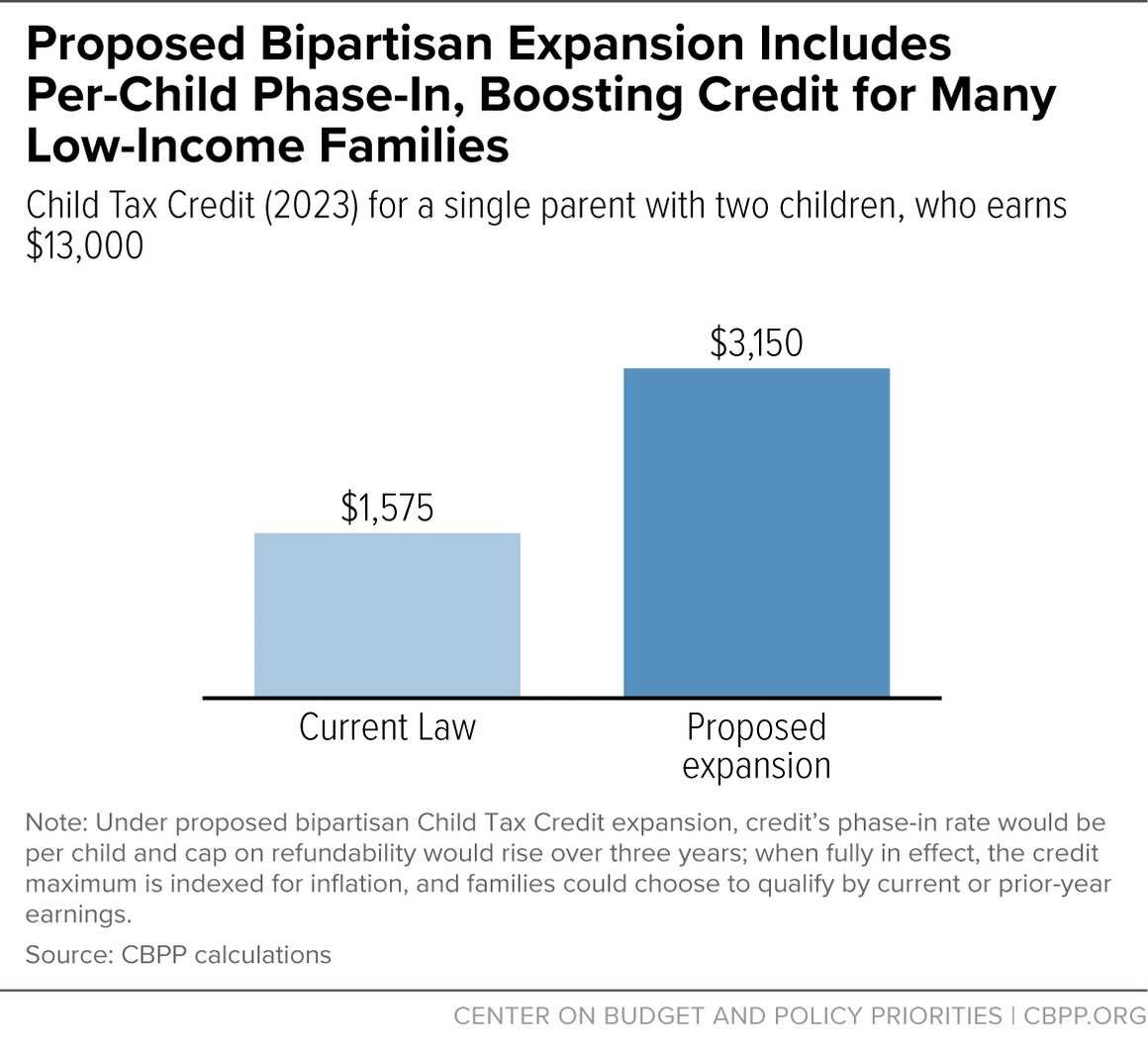

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

Equity and Climate for Homes - Circulate San Diego - Staging Environment

Low-Income Housing Tax Credit, Housing Program

Low Income Housing Tax Credit, Affordable Housing NYC

Message from Columbia Housing CEO Ivory N. Mathews (08/26/2021) - News - Affordable Housing, Columbia Housing Authority

Gov. Greg Abbott on X: Announcing over $87 MILLION in housing tax credits to finance the development & rehabilitation of affordable housing units across Texas. This funding will help improve affordable housing

LIHTC Provides Much-Needed Affordable Housing, But Not Enough to Address Today's Market Demands

2023 State of the Nation's Housing report: 4 key takeaways

Housing Mobility Strategies and Resources

The New Social Housing - Harvard Design Magazine

Revisiting the economic impact of low-income housing tax credits in Georgia

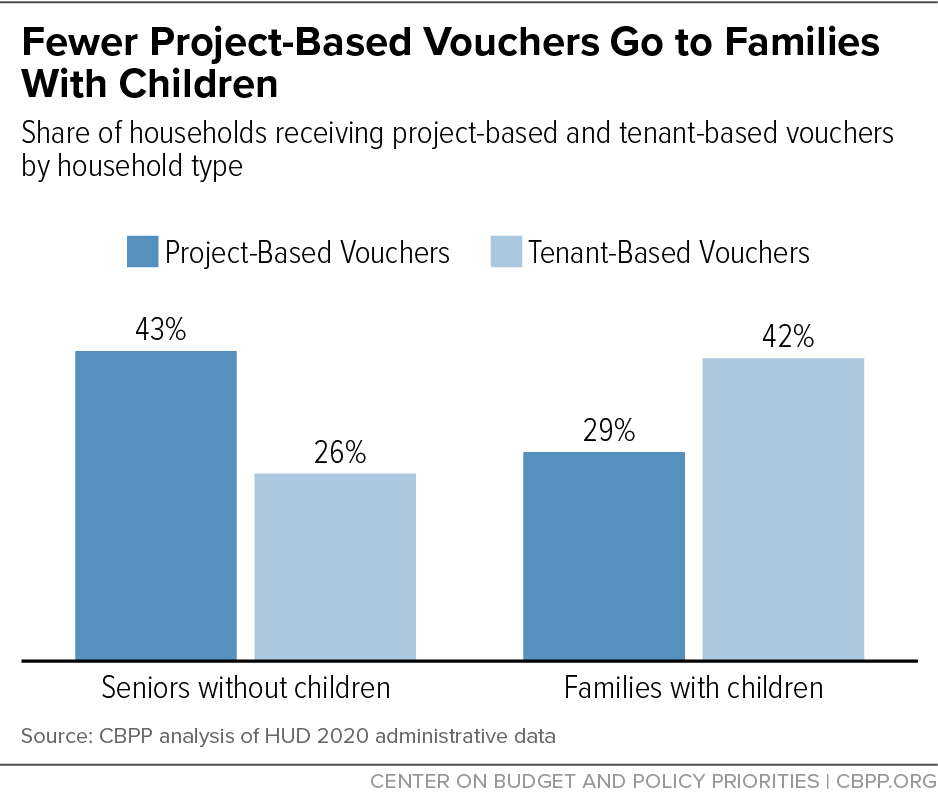

Project-Based Vouchers: Lessons from the Past to Guide Future Policy