HSA Eligible Expenses

DataPath helps TPAs get where they want to grow through innovative solutions for CDH accounts, COBRA, billing, and well-being benefits.

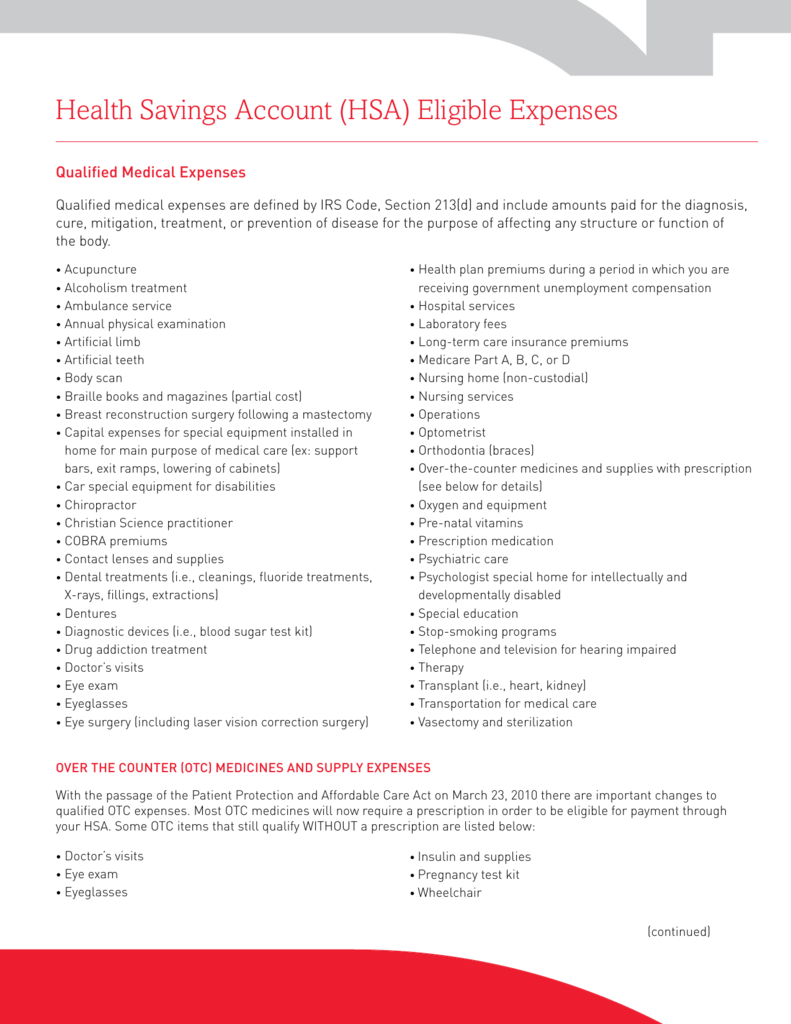

Since they were enacted in 2003, Health Savings Accounts (HSAs) have become an integral part of the consumer directed healthcare landscape for those with a high deductible health plan. One of the chief benefits of having an HSA is that account holders can use that money to pay for a wide range of eligible medical expenses for themselves, their spouses, and their tax dependents.

Health Savings Account (HSA) Eligible Expenses

16 Surprising FSA and HSA Eligible Expenses Your Employees Should Know About – Blue Horizon Benefits

HSA & FSA Eligible Expenses – Modern Frugality

What Qualifies As An HSA Eligible Expense?

HSA Eligible Expenses

Are You Maximizing the Benefits of Your HSA? - Harvard Pilgrim Health Care - HaPi Guide

%20(1).jpg)

Health Spending Account (HSA) Expenses [2024] - Dundas Life

Walkfit Platinum Orthotics- Size K (M 14 - 14.5) : : Health & Personal Care

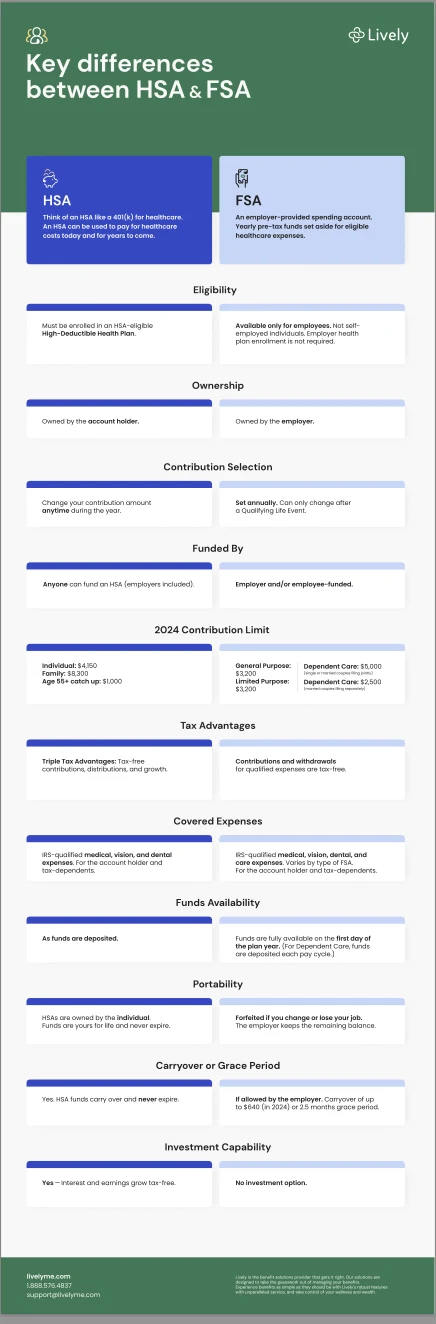

Infographic] Differences Between HSA vs Healthcare FSA

Some Nutritional Needs Qualify as FSA/HSA-Eligible Expenses - DataPath Administrative Services

Are Diapers FSA / HSA Eligible?

What Qualifies for HSA Medical Expenses? - Ramsey

Eligible Expenses For Small Businesses - FasterCapital

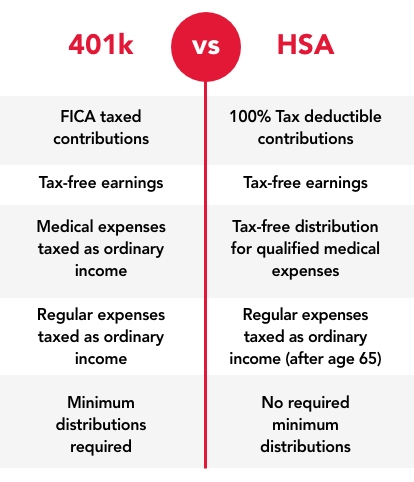

What Exactly is an HSA?, Learning Center

List: Eligible Medical Expenses (Humana)