Low-Income Housing Tax Credit Program

The Fund is responsible for administering the Low-Income Housing Tax Credit Program, which generates low-income residential rental units by encouraging private investment through federal tax credits. Since its inception, this program has produced more than 17,200 affordable rental units in West Virginia. If you are interested in receiving updates on the Fund’s Low-Income Housing Tax […]

The Impact of Low-Income Housing Tax Credits on Affordable Housing in Texas - Texas State Affordable Housing Corporation (TSAHC)

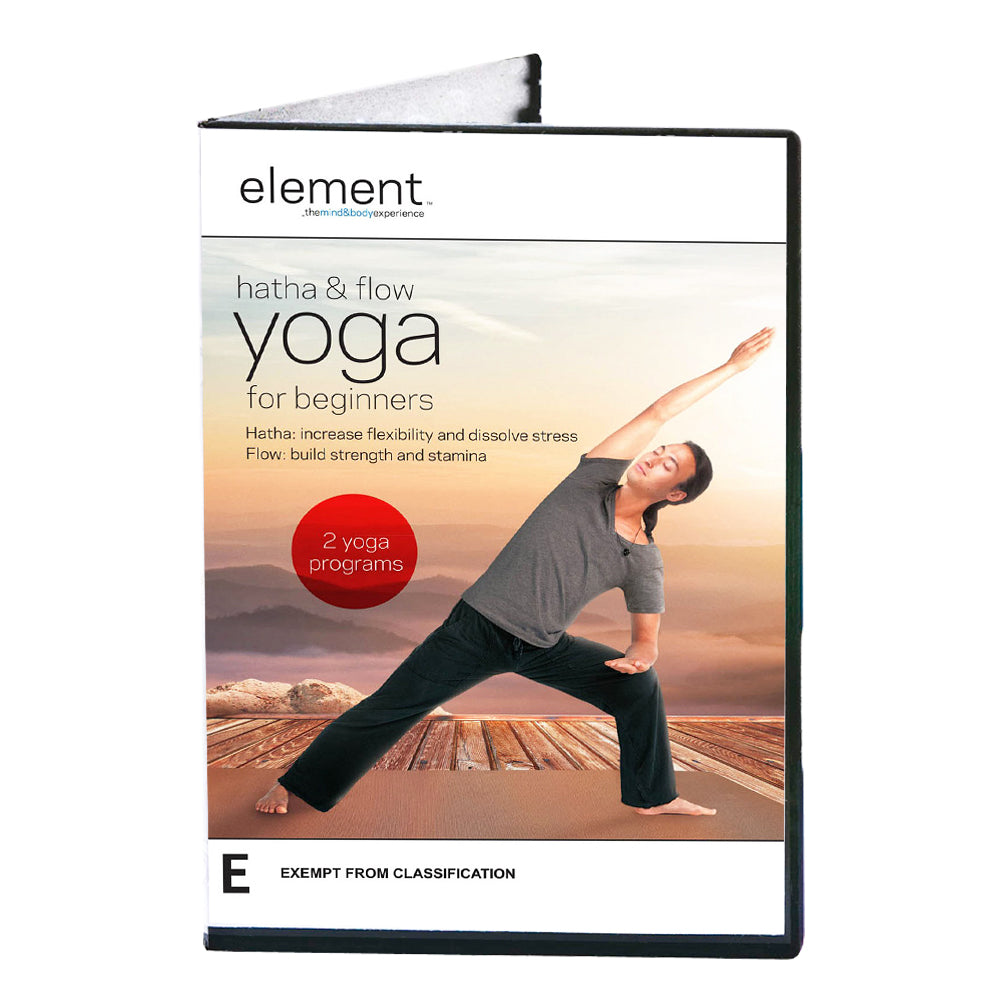

Improving the Spatial Equity of the Low-Income Housing Tax Credit Program

Maximizing LIHTC: Twinning 9% and 4% Tax Credits

What Is the Low-Income Housing Tax Credit Program?

The Effects of the Low-Income Housing Tax Credit (LIHTC) – NYU Furman Center

Low Income Housing Tax Credit Program - Keep Pushing Costs Back

Opportunity Zones

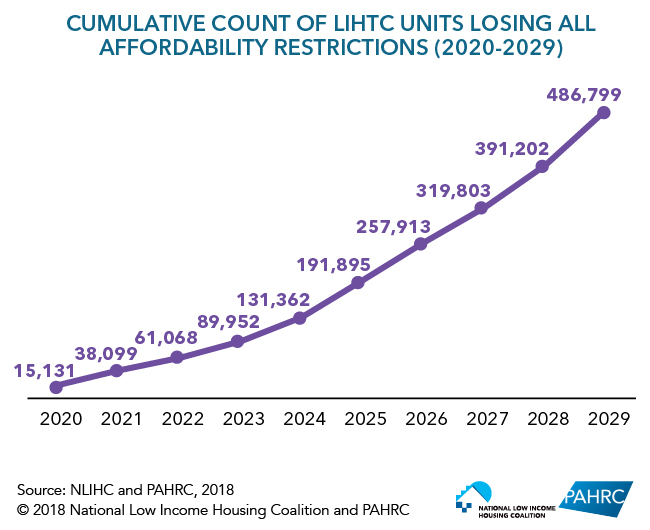

Balancing Priorities: Preservation & Neighborhood Opportunity in

New Report Finds Bay Area Needs 235,656 More Affordable Homes

Who Really Pays for Affordable Housing - Texas State Affordable Housing Corporation (TSAHC)

Texas Awards $67 Million in LIHTCs