How Buy Now Pay Later Instant Credit is Changing B2B Transactions

BNPL (the buy now pay later) for consumers has been around for a while. If you’re looking for a BNPL for B2B transactions, here are some factors to consider.

Resolve helps merchants grow B2B sales, get paid faster, and reduce risk by streamlining their net terms, accounts receivable, and payments processes.

:max_bytes(150000):strip_icc()/how-to-keep-your-debit-card-transactions-safe.aspx-Final-0c92611f34934a92bcc0e2e86fa6b1fc.jpg)

8 Rules to Keep Online Debit Card Transactions Safe

The Impact of Buy Now Pay Later (BNPL) on the Business-to-Business

%20(Document%20(A4))%201%20(1).png)

B2B Buy Now Pay Later vs Traditional Trade Credit

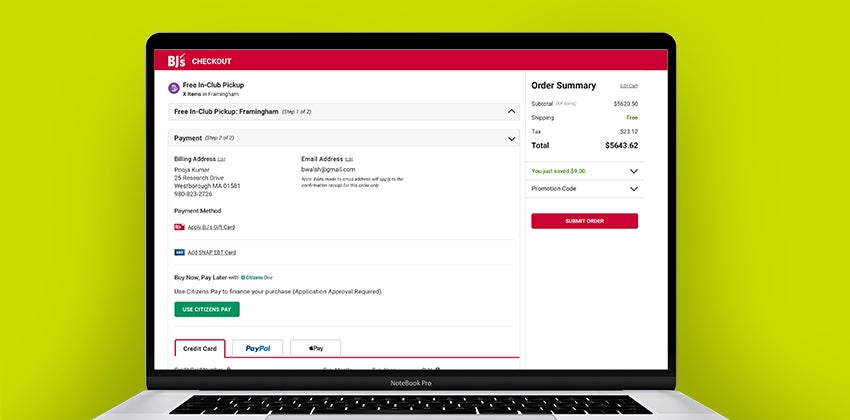

Buy now, pay later Stripe Documentation

:max_bytes(150000):strip_icc()/payment.asp-Final-25aad0eedda34c9db463c665991c6323.jpg)

Guide to Payment Types, With Pros and Cons for Each

:max_bytes(150000):strip_icc()/CalculateCardPayments4-a6570a7d2e36410b9980f4833a4f8f6e.jpg)

Calculate Credit Card Payments and Costs: Examples

Kriya

Streamlining B2B Transactions with Buy Now, Pay Later (BNPL

:max_bytes(150000):strip_icc()/Affirm_Afterpay_Head_to_Head_Coinbase-9254222e1d7b46c9b689a0a1c9da8da2.jpg)

Affirm vs. Afterpay: Which Should You Choose?

When Were Credit Cards Invented: The History of Credit Cards

What is B2B Buy Now, Pay Later? The Comprehensive Guide