Plaintiff Recovery Trust - Reducing Taxes in Cases

EPTC is recognized internationally as leader in the trust industry. Our staff is comprised of internationally recognized trust experts that Federal and State courts regularly rely upon related to expert testimony, trust construction, administration, and administration matters.

Plaintiff Recovery Trust Taxable Settlement Planning

10 Things To Know About Taxes On Legal Settlements

What is a Capital Asset for Capital Gains Tax with Case Laws

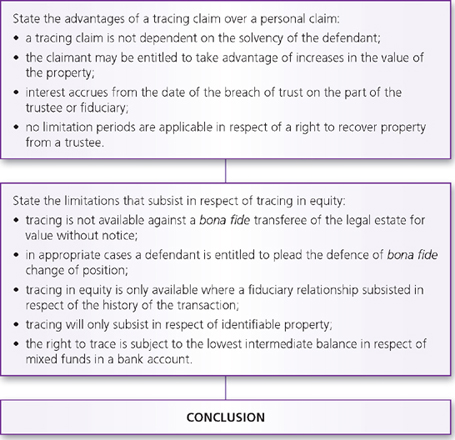

Breach of Trust

Plaintiff Recovery Trust: How to Double or Triple a Plaintiff's

Trust Tax Reporting Definition, Requirements, & Beneficiaries

Plaintiff Recovery Trust: How to Double or Triple a Plaintiff's

How Settlements and Legal Fees Are Taxed Post-Tax Reform - Appeal

Plaintiff Recovery Trust: How to Double or Triple a Plaintiff's

Are Punitive Damages Taxable? Here's What the IRS Says - Amicus

Art of Settlement Legal News by Jason D. Lazarus, Esq.

Plaintiff Recovery Trust - Reducing Taxes in Cases