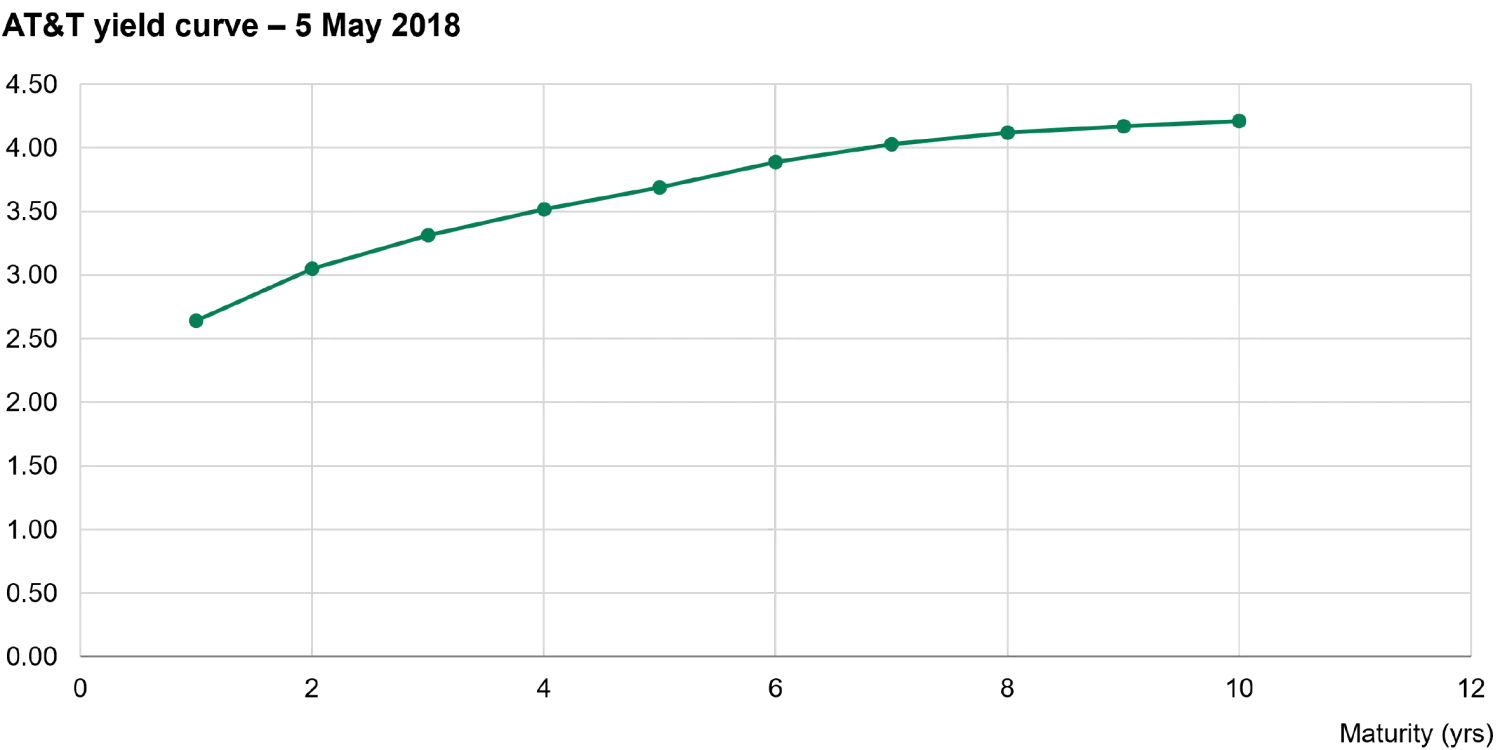

lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

Fixed Income 101: Roll-down

Financial Engineering Analytics: A Practice Manual Using R

Cross-asset carry: an introduction

Fixed income carry as trading signal

Riding the Yield Curve and Rolling Down the Yield Curve Explained

A Classic riding the yield curve strategy using T-bill

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

Fixed income: Carry roll down (FRM T4-31)

Roll down yield on upwards sloping YC : r/CFA

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

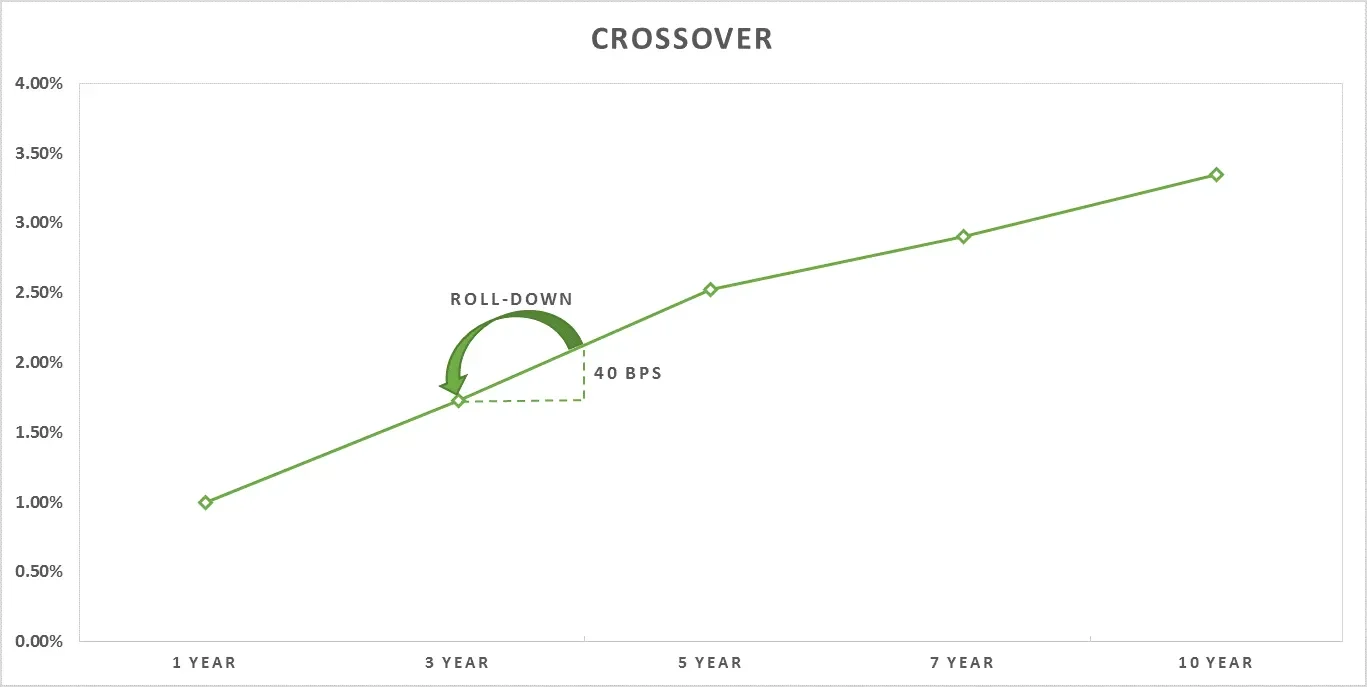

Roll Down explained TwentyFour Asset Management

Fixed income: Carry roll down (FRM T4-31)