Shinsegae Food will raise the sales price of more than 30 types of

No Brand Burger to raise prices by 3.1% on average Burden of rising raw and subsidiary materials, labor costs, public charges, etc. Cost-effectiveness menu to minimize customer burden Maintaining a set of 2,000 won or 4,000 won.

Sales of Packaged Samgyetang Surge amid High Cost of Dining Out

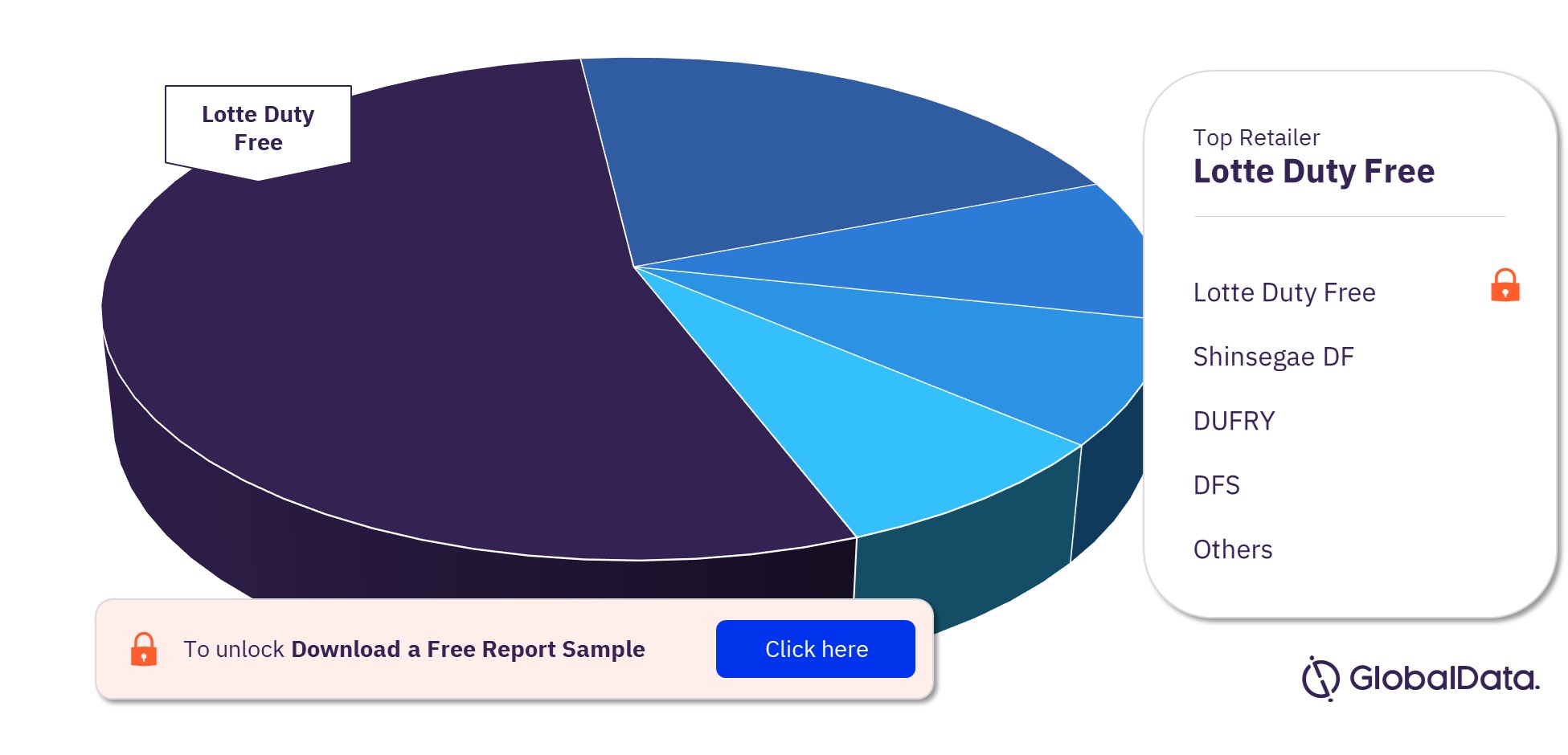

Duty Free Retailing Market Trends, Tourism Landscape, Key Players and Forecast to 2026

Trending Report on Home Meal Replacement (HMR) Market Size, Global and Regional Demand, Future Growth Opportunity

AI robots: South Korea changes how people dine: AI robots negate contact with staff, serve customers - The Economic Times

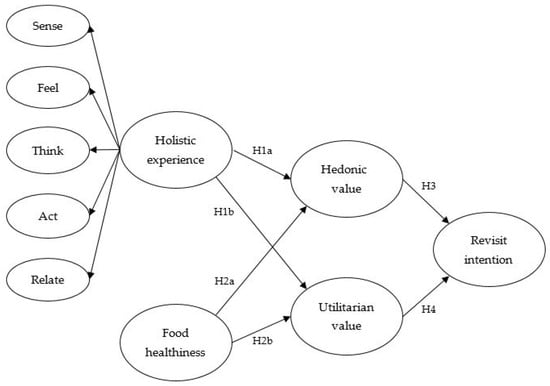

Sustainability, Free Full-Text

Korea redefines dining experience with meal kits and delivery food - KED Global

Korean food, retail firms cut jobs as spending drops - KED Global

Retail Asia (June 2022) by Charlton Media Group - Issuu

Indonesia: value growth rate of food segment 2023

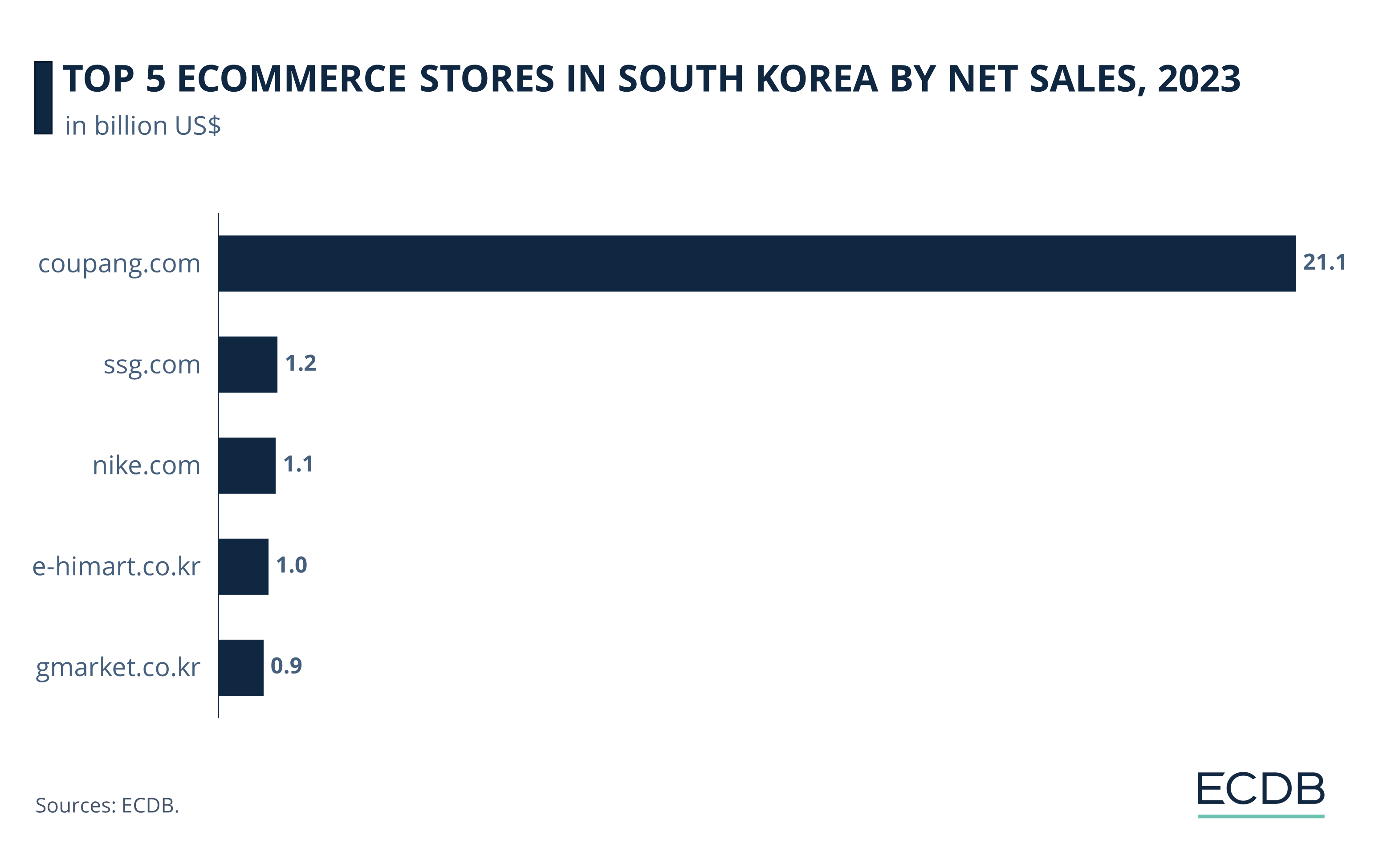

eCommerce in South Korea: Coupang, Lotte Hi-Mart, Shinsegae

Nationwide surge in food prices shows retail inflation far from tamed - The Hindu

Bigger isn't better: Why convenience stores will rule Asian retail over the next five years