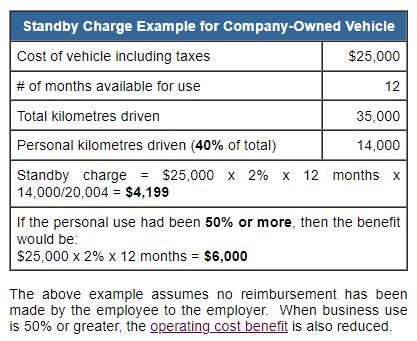

Small Business - Automobile Taxable Benefits - Operating Cost Benefit

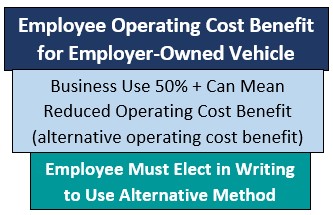

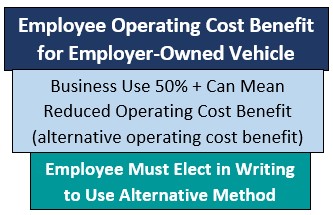

Automobile Taxable Benefits - Operating Cost Benefit, Reduction if Business Use 50% +

What are the Taxable Benefits for Non-Cash Operating Costs?

Small Business - Automobile Taxable Benefits - Operating Cost Benefit

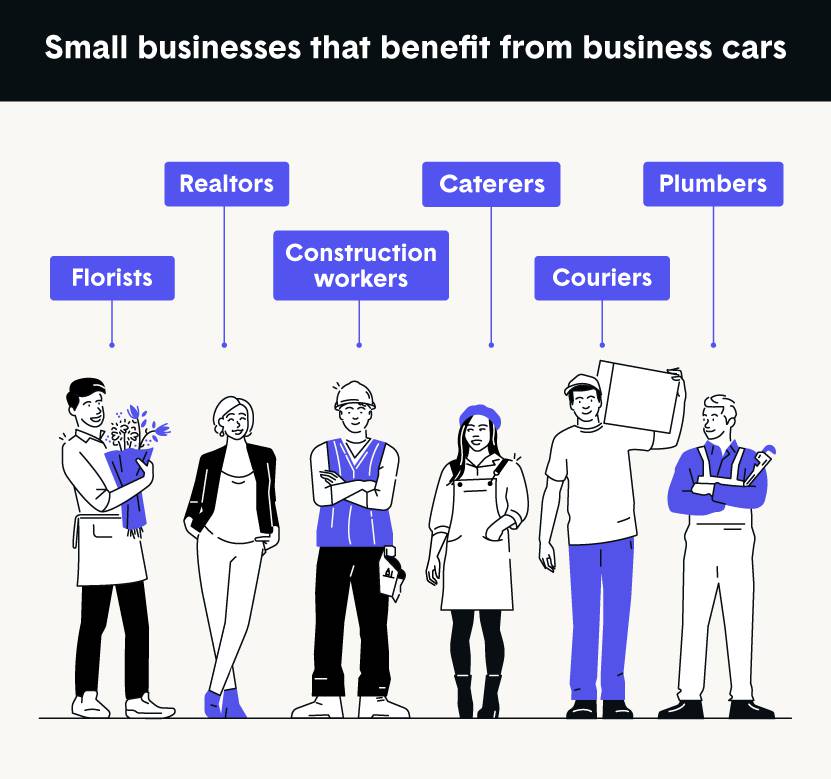

21 Tax Write-Offs for Small Businesses Tax Deductions - Guide

:max_bytes(150000):strip_icc()/sgaExpenses-57d2c13f16bf417c805124f301e13ec4.jpg)

SG&A: Selling, General, and Administrative Expenses

2023 Automobile Deductions Limits & Expense Benefit Rates — ConnectCPA

Small Business Employee Benefits (2024 Guide) – Forbes Advisor

:max_bytes(150000):strip_icc()/BusinessInterestExpense-4a4af5f6e3be4e56a2a54bd5a1b9dddf.png)

Business Interest Expense: What it is, How it Works

Taxable Benefits In Canada: What You Should Know As An Employer

Buying a car for your business: 11 tips for a good small business investment

What Is a Write-Off? Definition & Examples for Small Businesses

Small Business - Automobile Taxable Benefits - Standby Charge

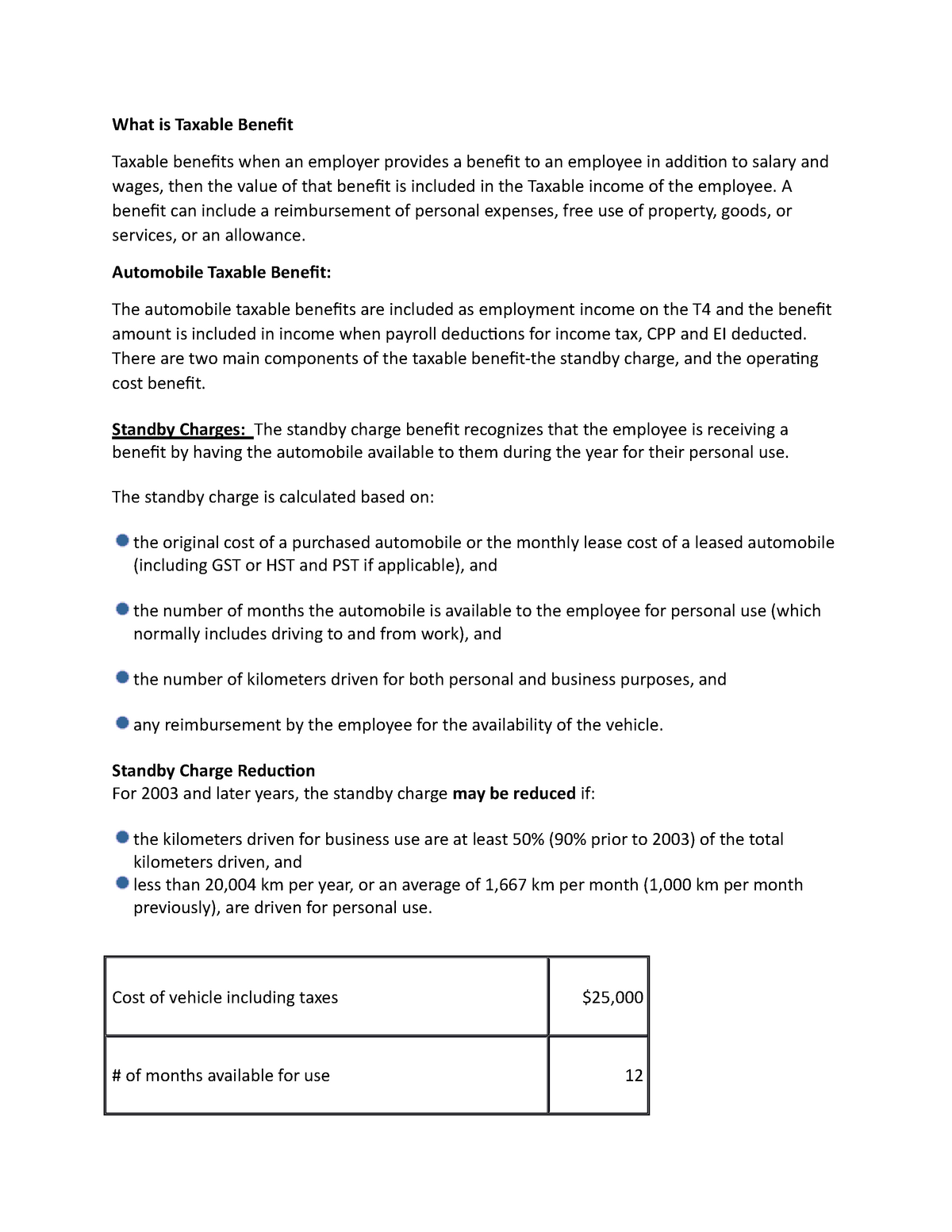

Taxable Benefits-Presentation - What is Taxable Benefit Taxable benefits when an employer provides a - Studocu

17 Big Tax Deductions (Write Offs) for Businesses