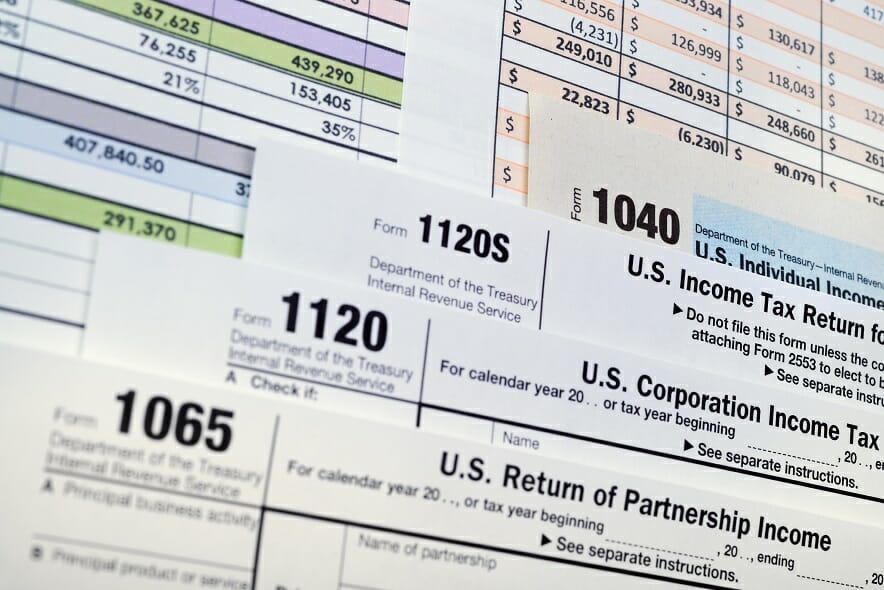

Tax Brackets in the US: Examples, Pros, and Cons

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

Description

A tax bracket is a range of incomes subject to a certain income tax rate.

Negative income tax - Wikipedia

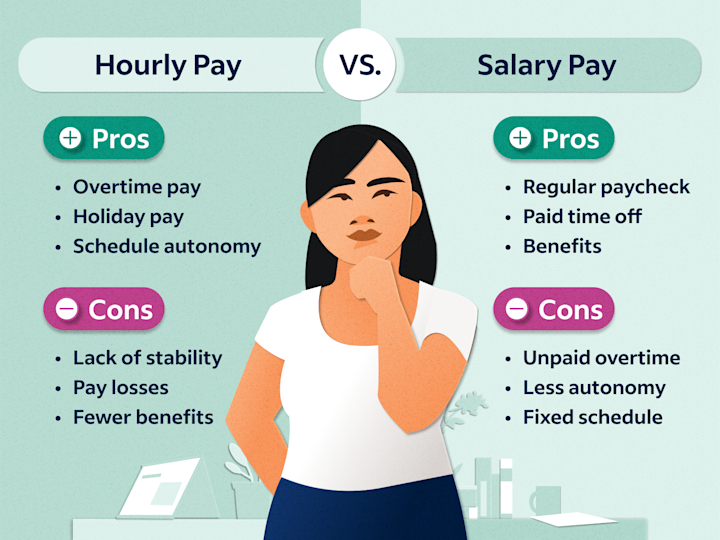

Being Paid on Salary: Pros and Cons

:max_bytes(150000):strip_icc()/mfs.asp-final-92d6cd107fec480fa0bcbe2343401c9f.jpg)

Married Filing Separately Explained: How It Works and Its Benefits

:max_bytes(150000):strip_icc()/4-HowMuchDoesitCostToRetireInTheUS-v2-cf4eca0a8b4a4f459f56ae10d4b320a7.png)

9 States With No Income Tax

:max_bytes(150000):strip_icc()/550437717-56a9392b5f9b58b7d0f961d7.jpg)

Withholding Tax Explained: Types and How It's Calculated

USA vs. Europe: Who Pays More in Taxes? [Comparison]

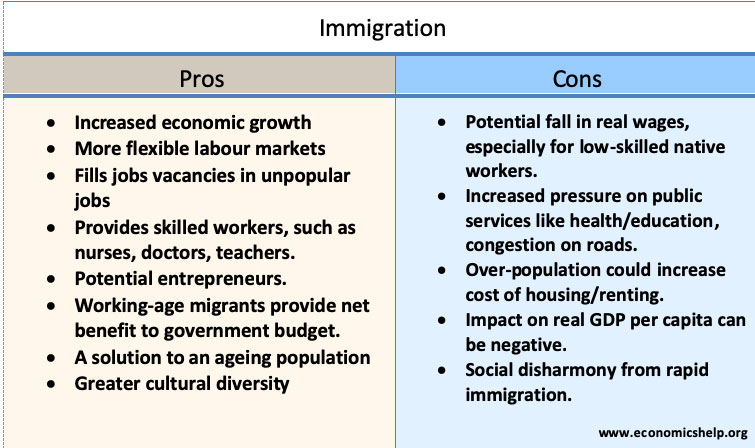

Pros and cons of Immigration - Economics Help

Tax Brackets 2023: How They Work, Examples, and Myths

:max_bytes(150000):strip_icc()/taxliability.asp-final-a8ea9ba48a1f40149767a30961b171e6.png)

Tax Liability: Definition, Calculation, and Example

Withholding Tax Explained: Types and How It's Calculated

Taxable Income: What It Is, What Counts, and How To Calculate

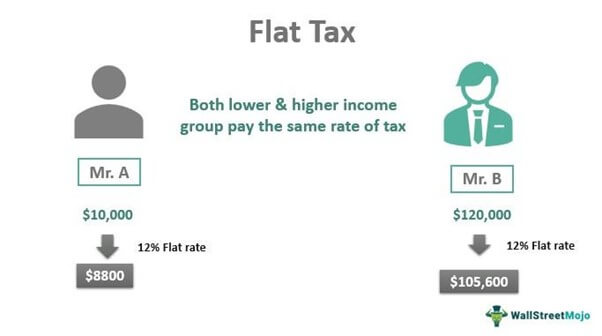

Flat Tax - Definition, Examples, Features, Pros & Cons

Flat Tax - Definition, Examples, How It Works, Pro/Con

Related products

Sign Bracket – 14.5” Cantilever Mount - Universal Group

Bra Bracket ,1 Pair, Spare Bracket, Metal - Canada

Women Self Adhesive Strapless Bandage Blackless Solid Bra Stick Gel Silicone Push Up Underwear Invisible Bra Bust Braces Support B Colour Black

Free Hanging Shelf Bracket, Wall Stud Bracket, Free Floating Shelf

$ 23.99USD

Score 4.5(665)

In stock

Continue to book

$ 23.99USD

Score 4.5(665)

In stock

Continue to book

©2018-2024, paramtechnoedge.com, Inc. or its affiliates