Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

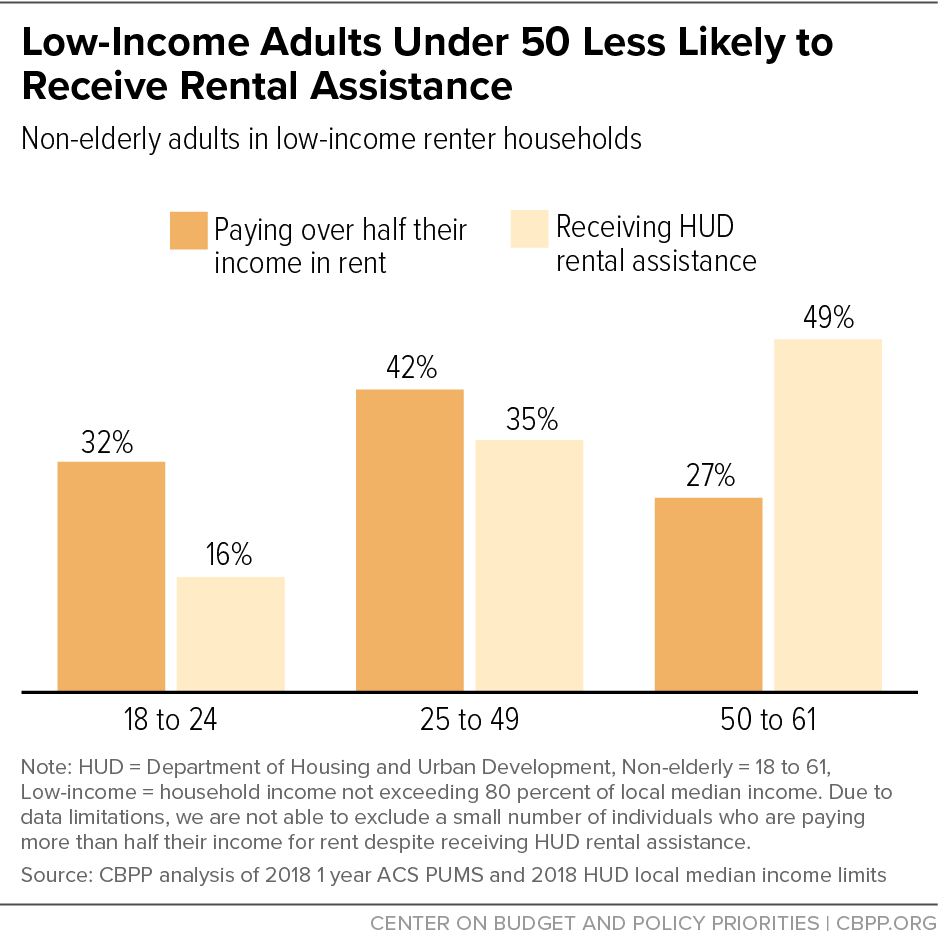

A Frayed and Fragmented System of Supports for Low-Income Adults Without Minor Children

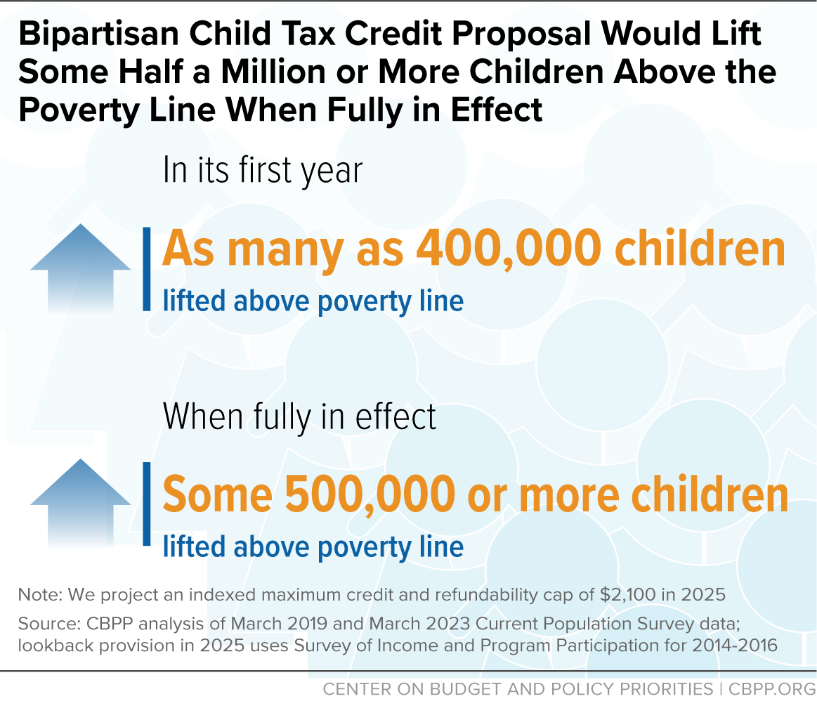

Parents Might Get a Boosted Child Tax Credit Through a New Bipartisan Plan

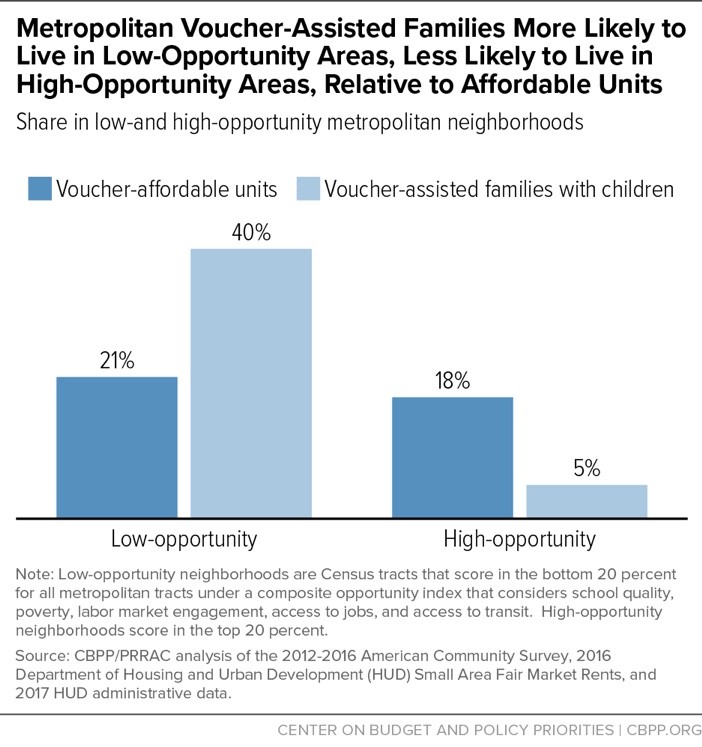

Where Families With Children Use Housing Vouchers

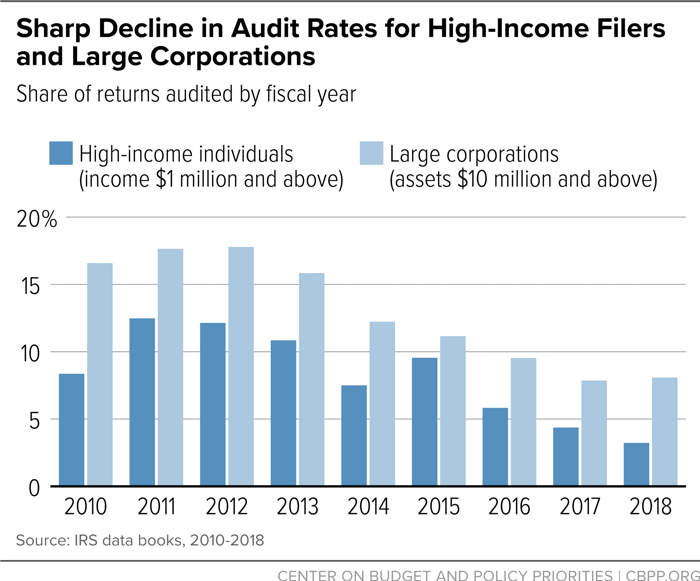

How the Federal Tax Code Can Better Advance Racial Equity

/cdn.vox-cdn.com/uploads/chorus_image/image/72025056/1244775498.0.jpg)

It's time for Biden to prioritize the affordable housing shortage

Using LIHTC to Expand Access to Opportunity

Four Ways to Improve Portland's Housing Affordability Mandate - Sightline Institute

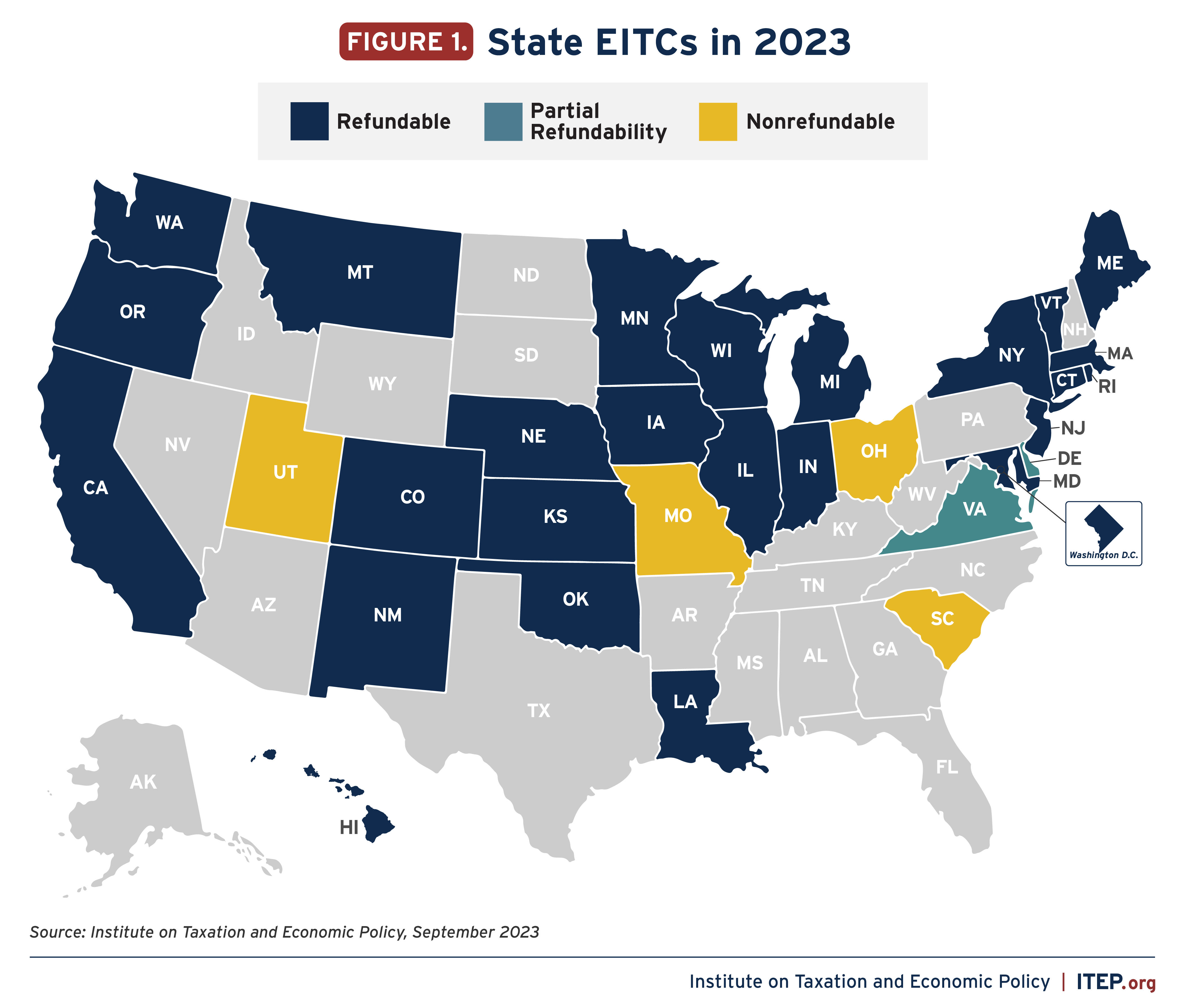

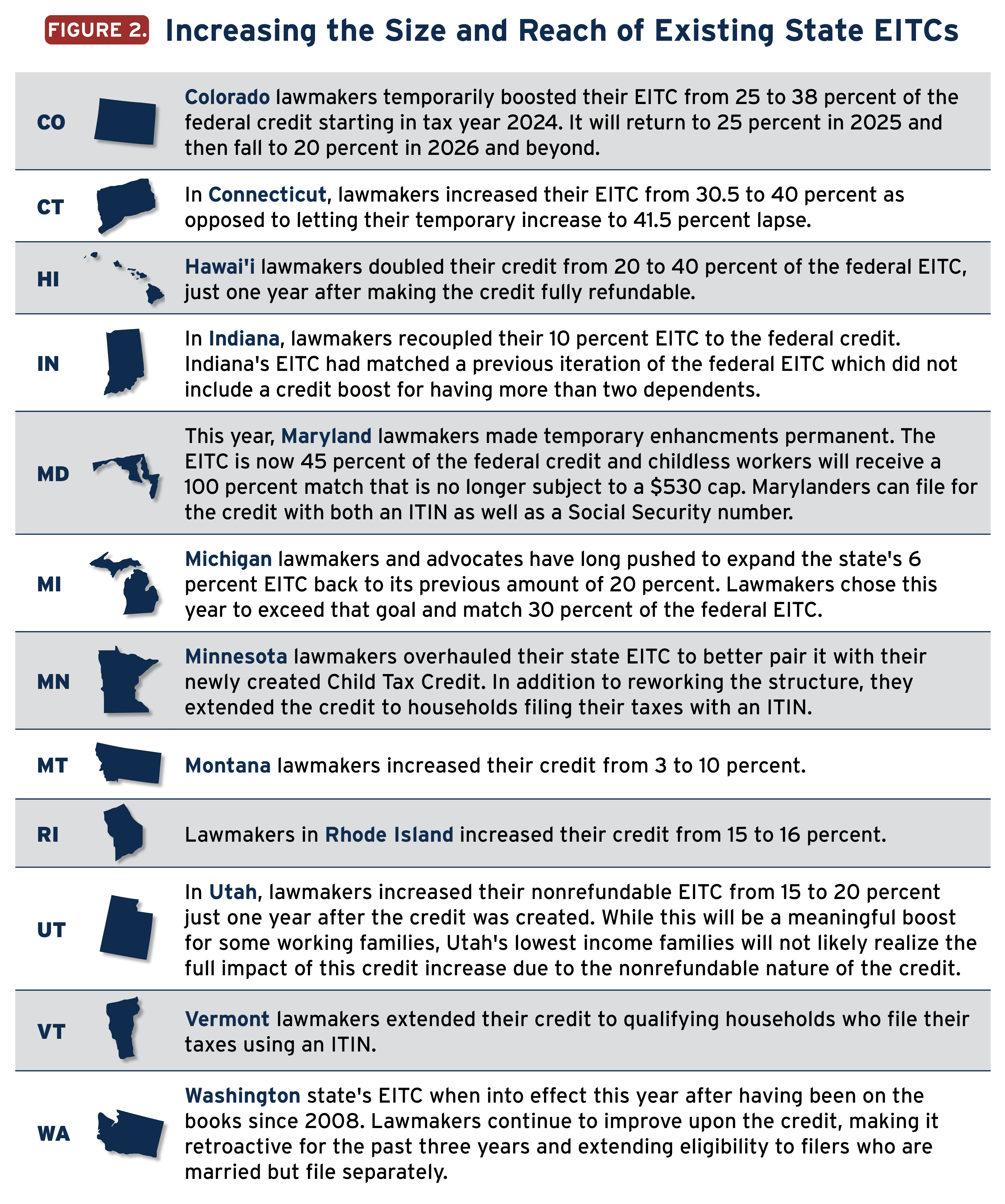

Boosting Incomes, Improving Equity: State Earned Income Tax

Trump-era Opportunity Zones meant to help low-income communities

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

Congress proposes child tax credit increase for 2024

Boosting Incomes, Improving Equity: State Earned Income Tax

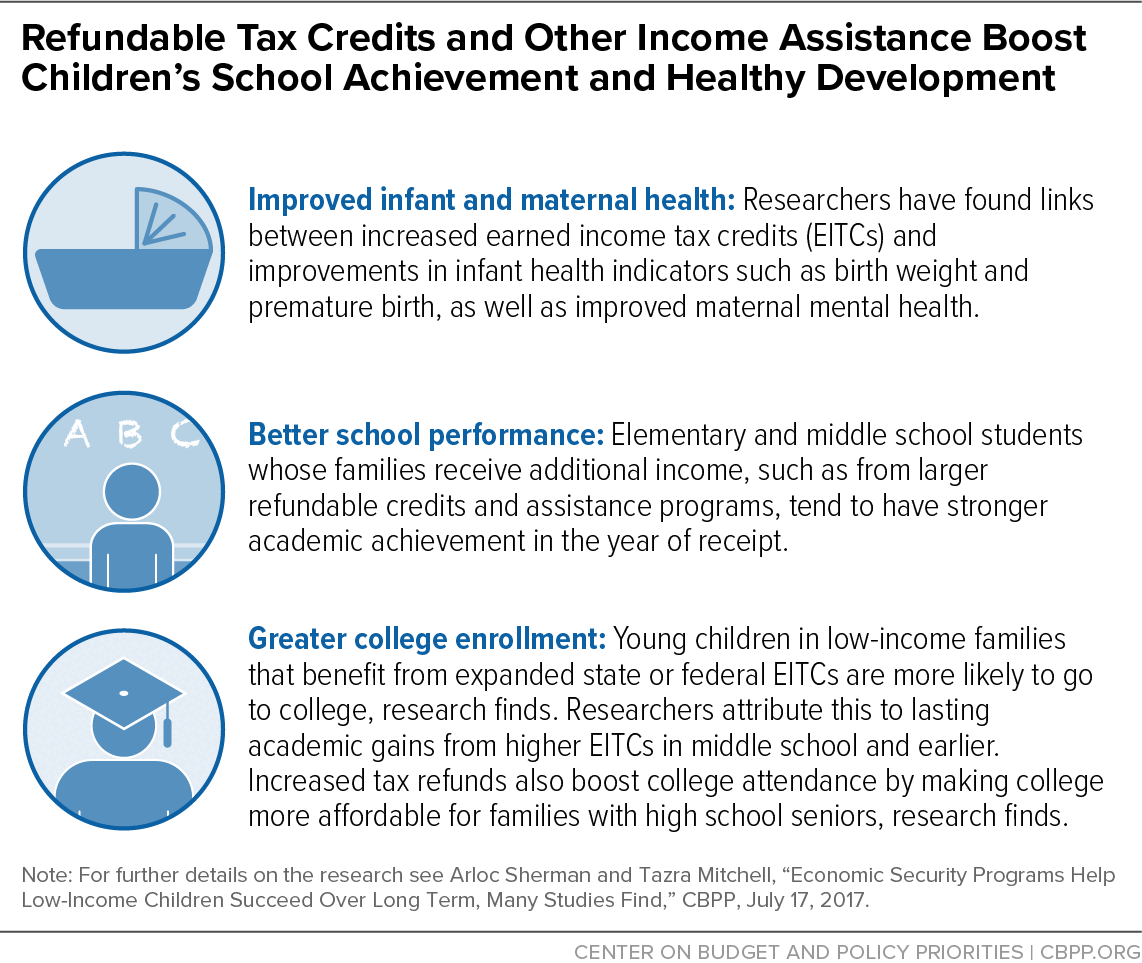

Income Support Associated With Improved Health Outcomes for Children, Many Studies Show