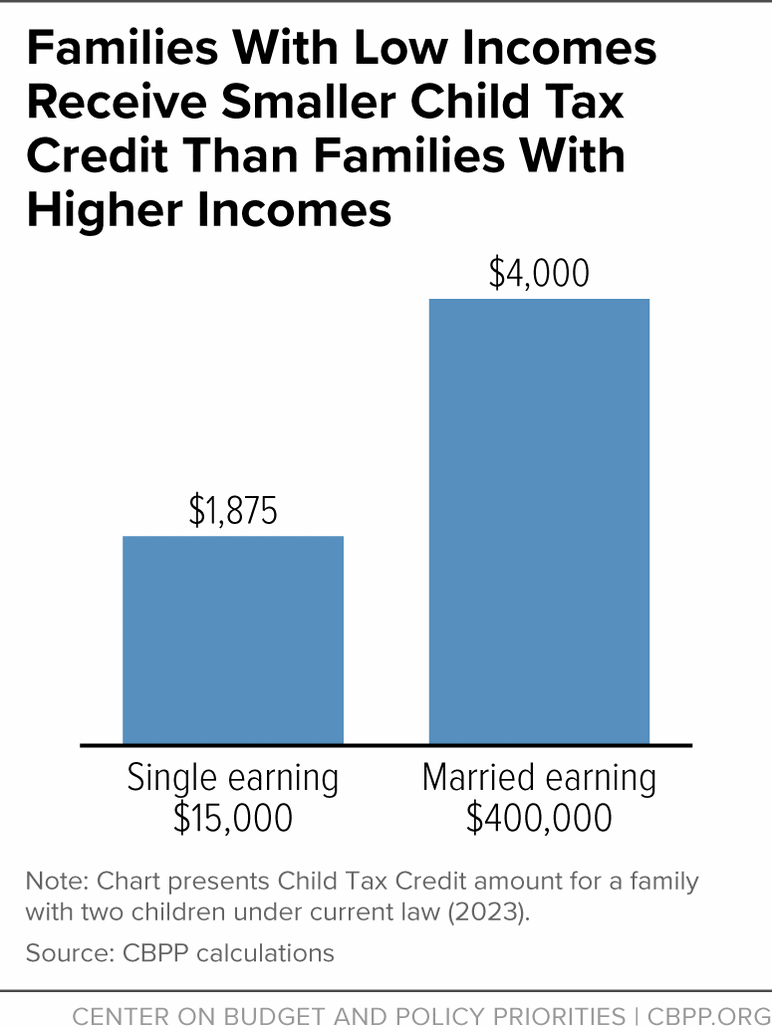

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

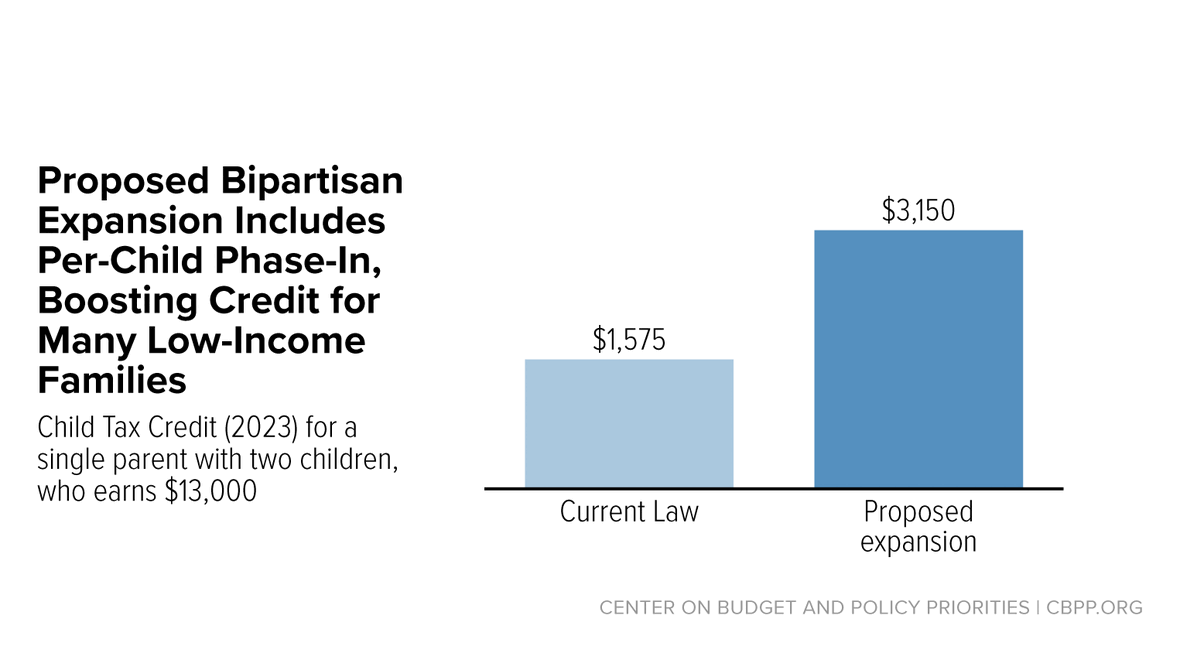

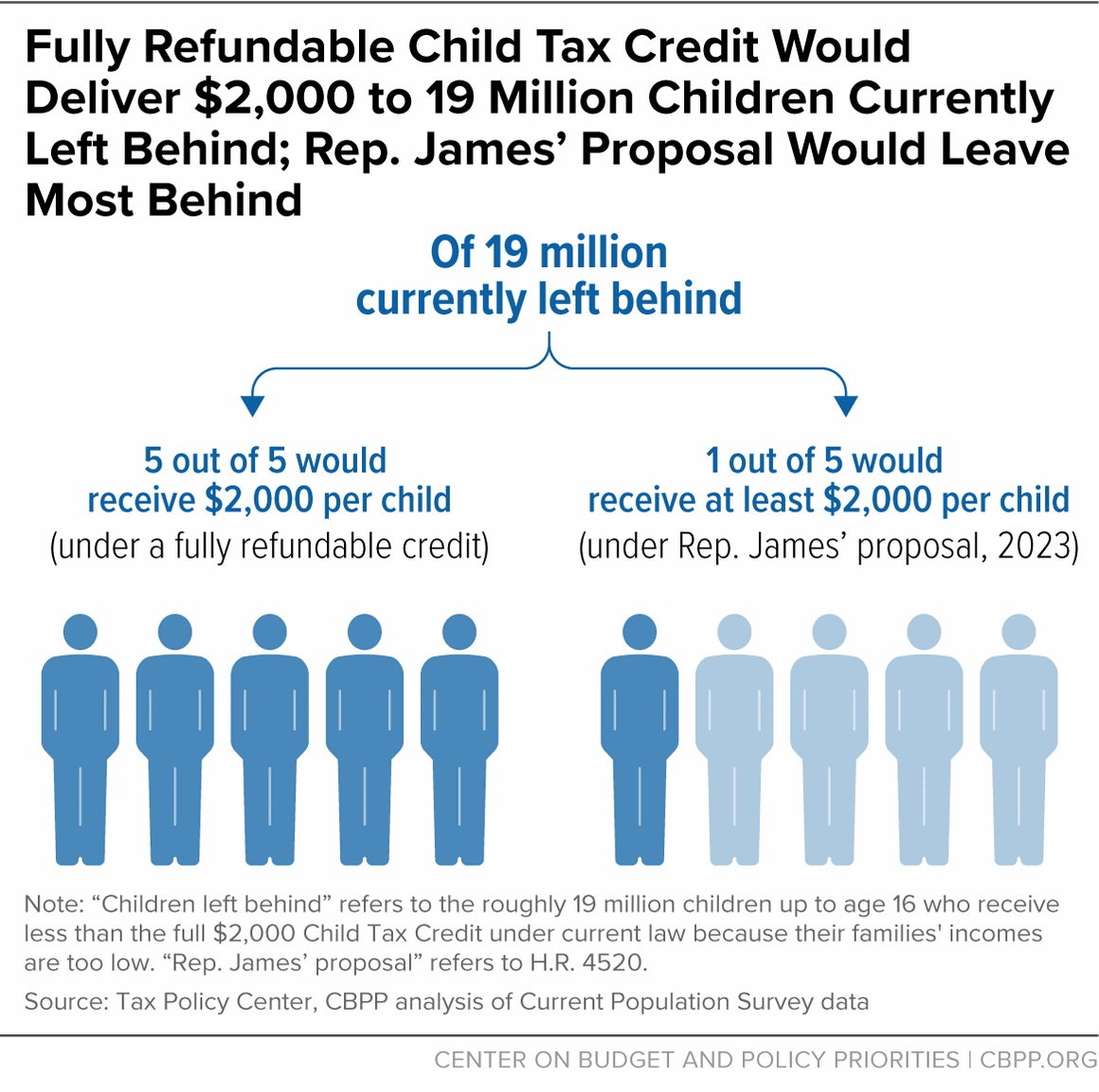

Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

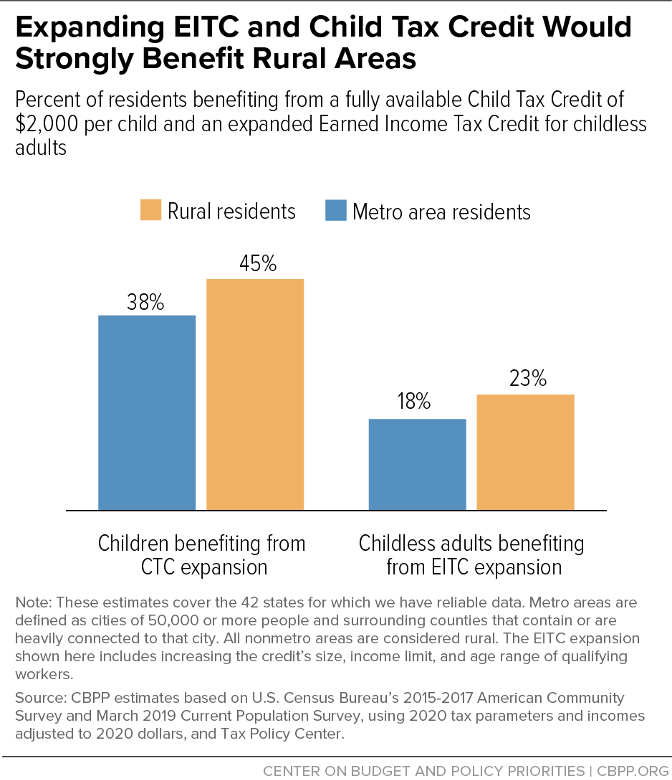

Expanding Child Tax Credit and Earned Income Tax Credit Would

Bipartisan Child Tax Credit Expansion Would Benefit About 6

Romney Child Tax Credit Proposal Is Step Forward But Falls Short

Earned Income Tax Credit (EITC) and Other Tax Credits

Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

EITC: General Information and Fact Sheets

Mike Bloomberg calls for public option in 2020 health-care proposal

Republican Tax Credit Proposal Would Provide New Breaks to Tax

Mayor Schor reminds Lansing residents of tax and financial

What Are Tax Credits - FasterCapital