Venture Capital-Backed IPO: What it is, How it Works, Example

:max_bytes(150000):strip_icc()/GettyImages-835976568-74bf00086a4d4dc7a14a477223052519.jpg)

A venture capital-backed IPO refers to selling to the public shares in a company that has previously been funded primarily by private investors.

Venture Capital

What is Venture Capital (VC) & How Does it Work?

What is a Venture-Capital-Backed IPO? #ipo

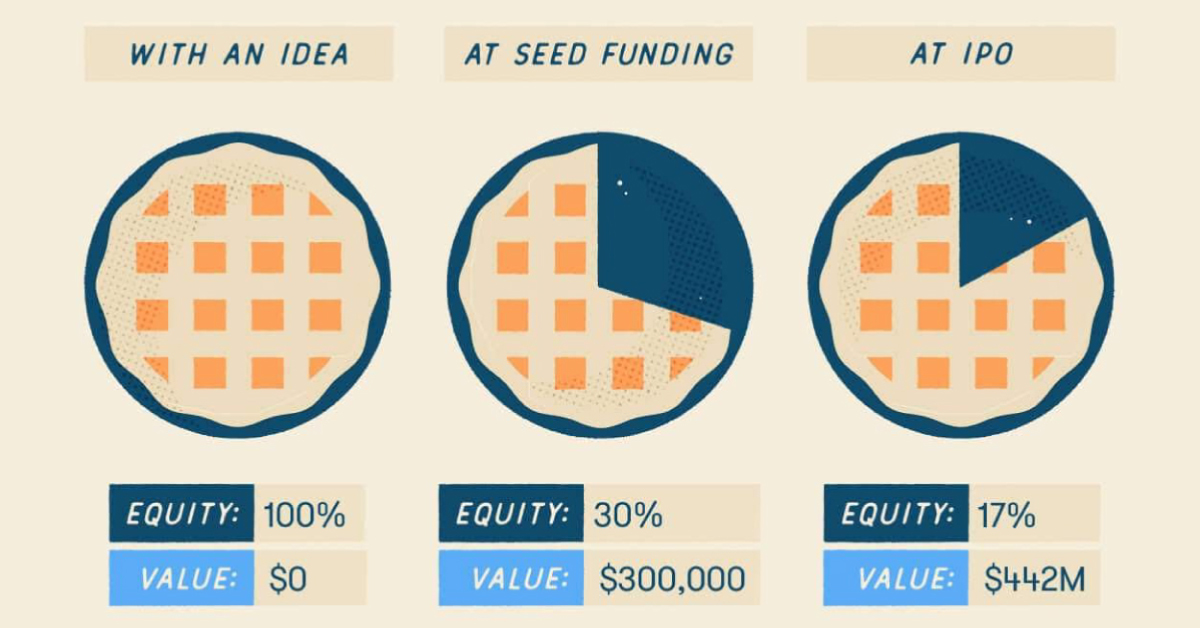

Visualizing the Stages of Startup Funding From Pre-Seed to IPO

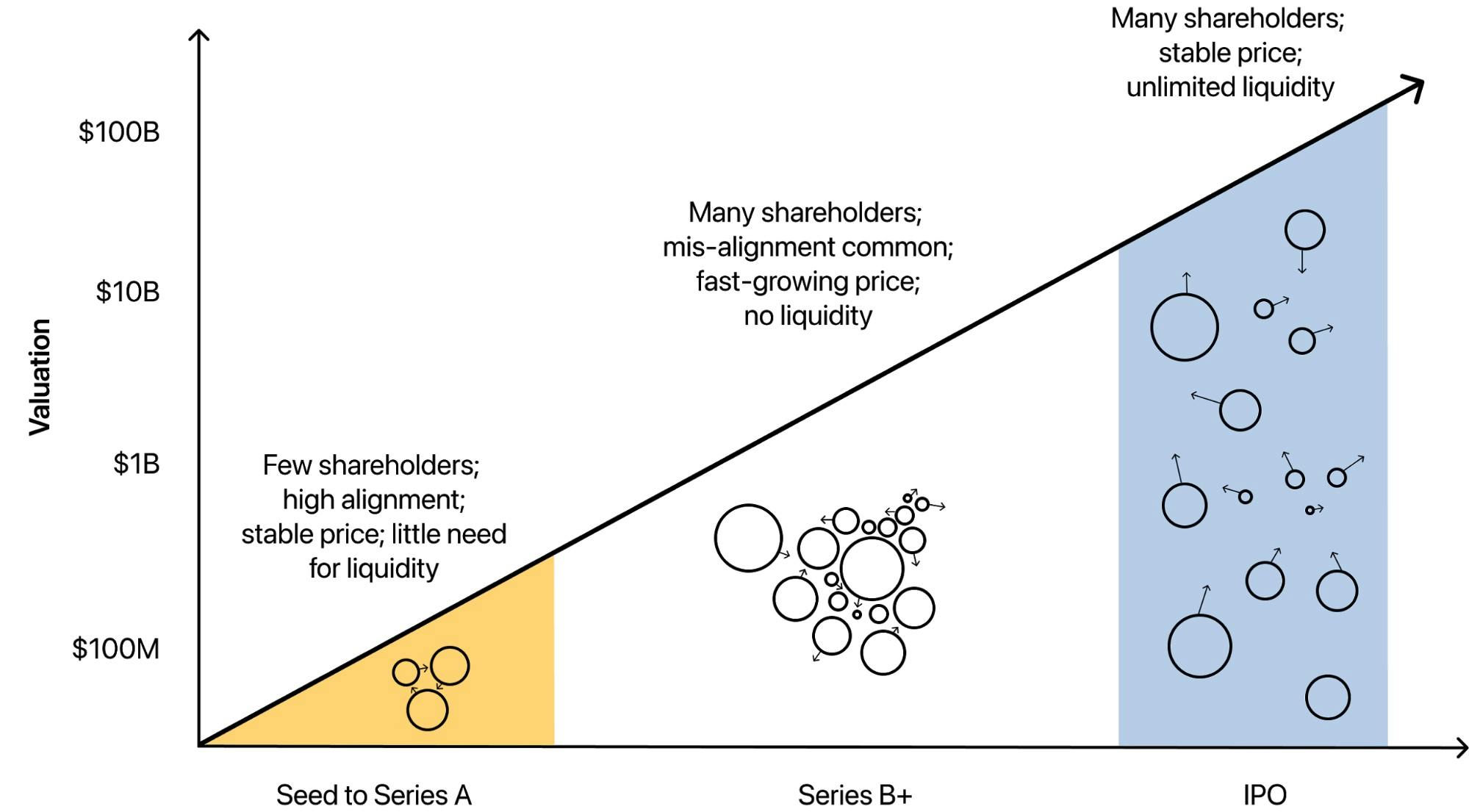

The Privately-Traded Company: The $225 Billion Market for Pre-IPO Liquidity

What is a Venture-Capital-Backed IPO? #ipo

:max_bytes(150000):strip_icc()/Seasons.asp-Final-54f07384ee97484b892a7705696307c5.png)

Essentials of Private Equity and Venture Capital

Does Venture Capital Backing Improve Disclosure Controls and Procedures? Evidence from Management's Post-IPO Disclosures

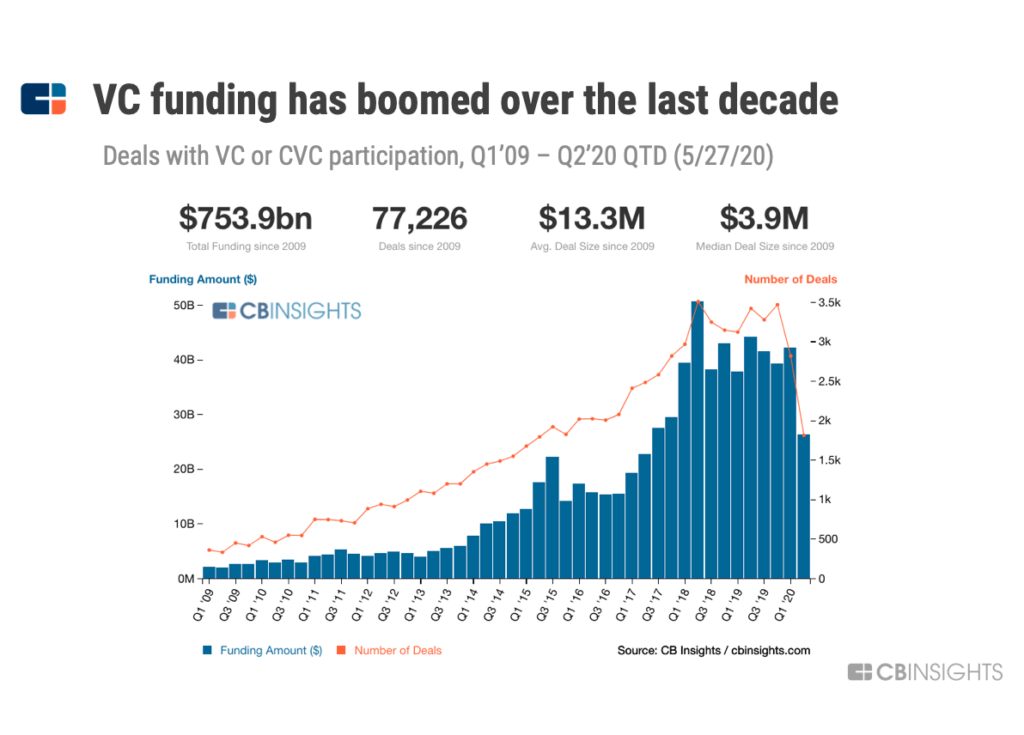

The new reality of venture capital – Founder Equity Fund

:max_bytes(150000):strip_icc()/Backup_v2-885e756806ce497b9565ea1fc1b75ae4.jpg)

Initial Public Offerings (IPOs)

Introduction to VC - Venture Forward

ESG for Venture-Capital-Backed Companies: What Should Climate Tech Startups Consider?

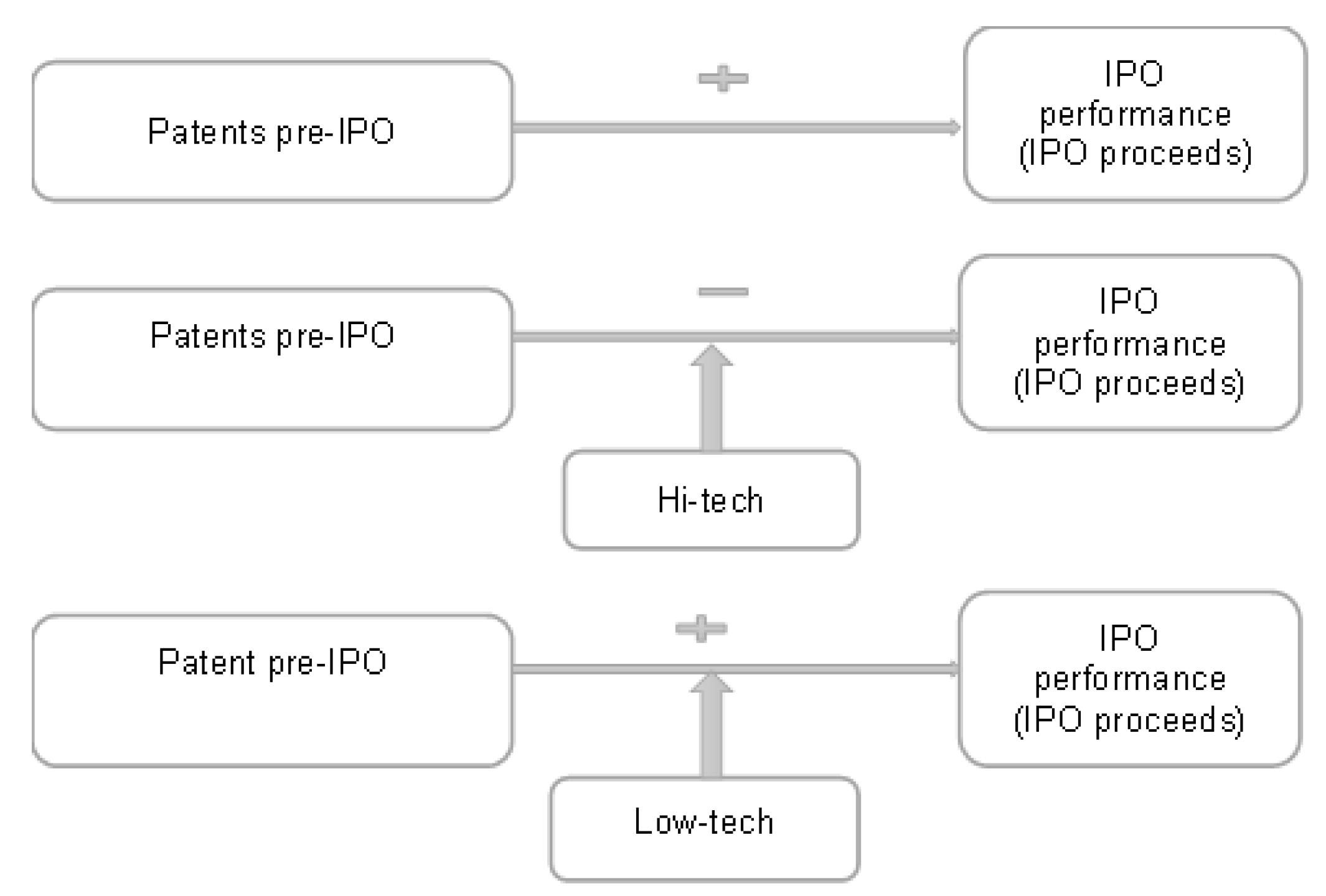

Economies, Free Full-Text

Venture-Capital-Backed IPO - Overview, Funding, Debt Financing

:max_bytes(150000):strip_icc()/shutterstock_696546448-5bfc31f5c9e77c0026b62ca2.jpg)

Nordstrom Stock Soars on Report That Founding Family is Looking at

.png)