:max_bytes(150000):strip_icc()/twenty-eight-thirty-six-rule.asp_final-8aea4a4d663140c1865477bb578fcddd.png)

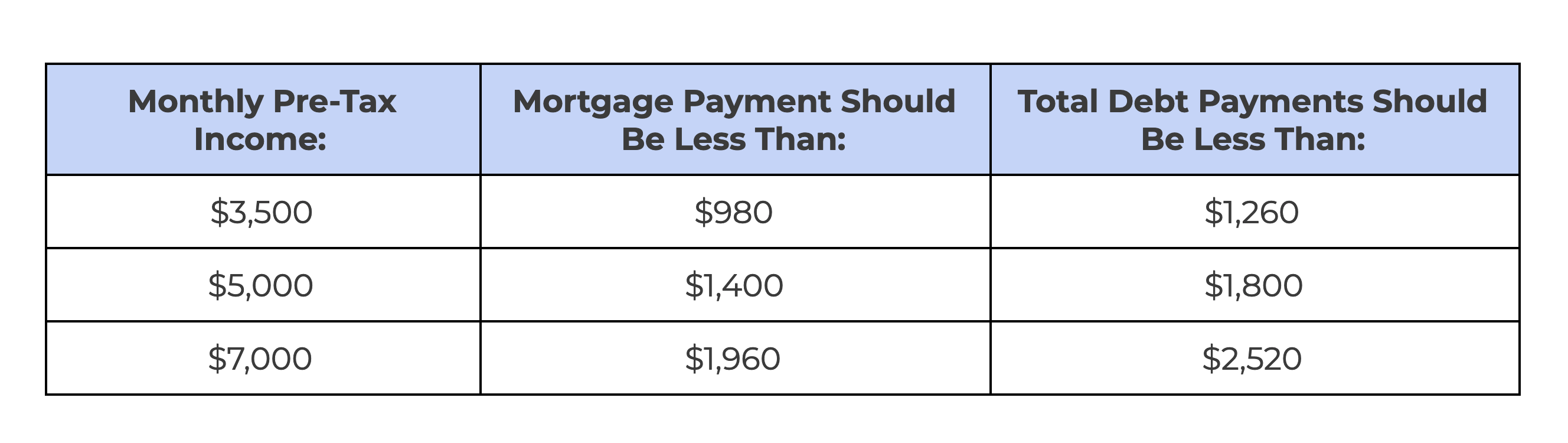

The 28/36 rule calculates debt limits that an individual or household should meet to be well-positioned for credit applications. It measures income against debt.

Premium Vector 28 36 rule that housing debt should be within 28 and all debt within 36

Math & YOU, 2.4 Budgeting

Avoid These 7 Critical Financial Planning Mistakes

28/36 : 🌐 McKinsey's Pyramid Framework for storytelling

Home Buying Budget: How Much House Can I Afford?

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

28/36 Rule: What It Is, How to Use It, Example

Average Student Loan Payment [2023]: Cost per Month

What Percentage of Income Should Go to Mortgage?

What Is the 28/36 Rule in Mortgages? - SmartAsset

:max_bytes(150000):strip_icc()/GettyImages-83590515-b6a1a4d3e3704ab7adf1ea4e4d7b12c8.jpg)

28/36 Rule: What It Is, How to Use It, Example

FY 2017 Medicare Inpatient Prospective Payment System (IPPS) - ppt download, rule 63 definition

Budgeting Techniques: Staying on Track with the 28 36 Rule - FasterCapital

washington home builders Archives - Holt Homes

cdn./Calculators/Images/home-affordabi

Division of Occupational Safety and Health - HRWatchdog, rule 63 definition

:max_bytes(150000):strip_icc()/happy-couple-talking-july-2023-getty-957fcfac323f48d5a00eb980159e4b92.jpg)