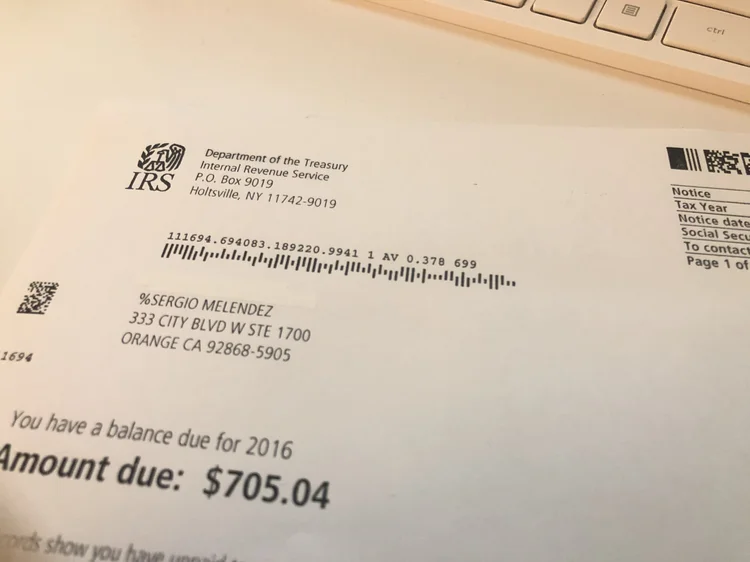

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

Description

Stay Ahead with IRS Tax Update 2023 & Tax CPE Courses

Determining the Date of Assessment for IRS Collection Purposes - CPA Practice Advisor

Contact us - Taxpayer Advocate Service

Taxpayer Advocate Service: Assistance with a Notice of Deficiency - FasterCapital

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

What Is a CP05 Letter from the IRS and What Should I Do?

Online account frequently asked questions

How to Contact the IRS (Online, by Phone, or in Person)

Why did I receive an IRS CP14 Notice? — Get rid of tax problems, Stop IRS Collections

February 2024, Tax & IRS Scams

Related products

You may also like

$ 26.50USD

Score 4.5(272)

In stock

Continue to book

You may also like

$ 26.50USD

Score 4.5(272)

In stock

Continue to book

©2018-2024, paramtechnoedge.com, Inc. or its affiliates