Chinese gold demand may rise 20% by 2017: industry body

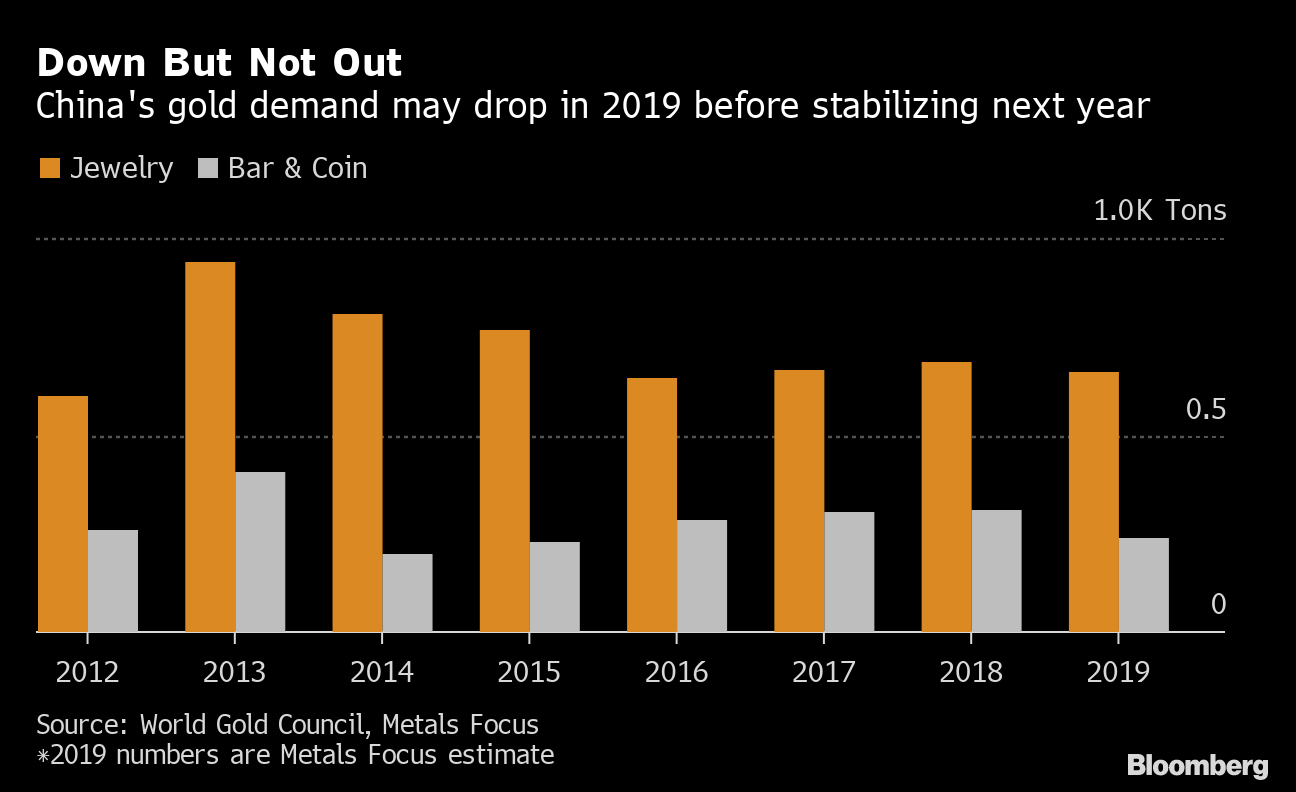

China's annual demand for gold could jump around 20 percent by 2017 as more of its increasingly wealthy population seek new ways to make money, the World Gold Council predicted on Tuesday. The forecast by the WGC comes after China became the world's largest gold-consuming nation in 2013, overtaking India. Annual demand for gold in the form of jewellery, coins and bars is set to hit "at least 1,350 tonnes by 2017", the WGC said in a report on China. Gold prices slumped by a nearly a third last year as investors abandoned the perceived safe haven investment in favour of stocks and other riskier bets.

China's annual demand for gold could jump around 20 percent by 2017 as more of its increasingly wealthy population seek new ways to make money, the World Gold Council predicted on Tuesday. The forecast by the WGC comes after China became the world's largest gold-consuming nation in 2013, overtaking India. Annual demand for gold in the form of jewellery, coins and bars is set to hit at least 1,350 tonnes by 2017, the WGC said in a report on China. Gold prices slumped by a nearly a third last year as investors abandoned the perceived safe haven investment in favour of stocks and other riskier bets.

China's annual demand for gold could jump around 20 percent by 2017 as more of its increasingly wealthy population seek new ways to make money, the World

Stock market today: Live updates

Gold Surge Dulls China Demand, Growth Woes Weigh on Shoppers - Bloomberg

2023 China Luxury Goods Market: A Year of Recovery and Transition

Chinese gold demand may rise 20% by 2017: industry body

Risks, Free Full-Text

The Risks of China's Property Bubble and Potential Impact on Gold Demand

Chinese gold demand may rise 20% by 2017

)

India considering to extend parboiled rice tax in risk to world supply

China's Rush to Gold Shows Few Signs of Fading, Council Says - Bloomberg

Gold consumption sees rebound amid global uncertainties, recovery

/cdn.vox-cdn.com/uploads/chorus_image/image/72135387/yllw_s1_ut_107_220602_reechr_00376rc3_3000_641b927e44d2e.0.jpg)