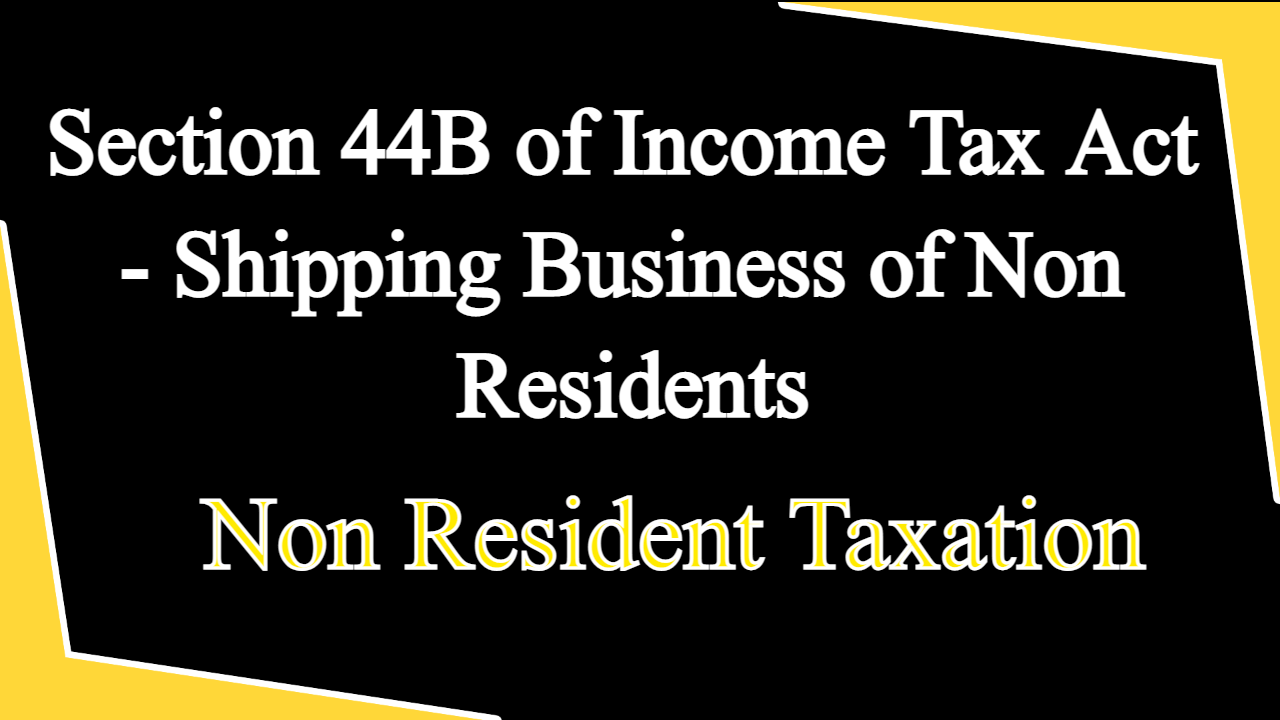

Section 44B of the Income Tax Act, 1961: TDS on income of Non Residents from shipping business on presumptive basis.

Income Tax Audit Under Section 44B in India

Audit Report u/s 44B furnished along with ITR before Completion of Assessment: ITAT deletes Penalty u/s 271B of Income Tax Act

DEEMED BUSINESS INCOME AND PRESUMPTIVE TAXATION - ppt video online download

section 44b income from shipping business of a non resident, corporate tax, income tax act 1961

Know all about the applicability of Minimum Alternate Tax (MAT)

Section 44B: Income From Shipping Business For Non-Residents

Complete List of Sections of Income Tax Act, 1961, PDF, Capital Gains Tax

Section 44AD,44ADA,44AE, 44B,44BB, 44BBB, 44BBA of Presumptive taxation under Income Tax Act 1961.

FAQs] Introduction & Applicability of Tax Audit

Section 64 Of The Income Tax Act: Clubbing Of Income And Eligibility

Presumptive Income under Income Tax Act, 1961

Income Tax Act, 1961: Types, List Of Chapters And More!

ITAT Annual Digest 2023 [Part 9]