What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

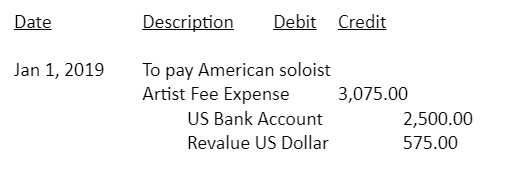

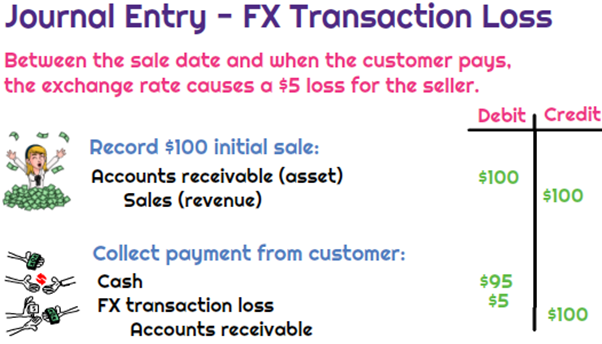

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

How do I record a US$ or other foreign currency transaction

AFAR-06 (Revenue From Customer Contracts - Other Topics)

Volume 14 Number 3 (July to September 2003) - University of the

Challenges and Next Steps in Working with International Clients

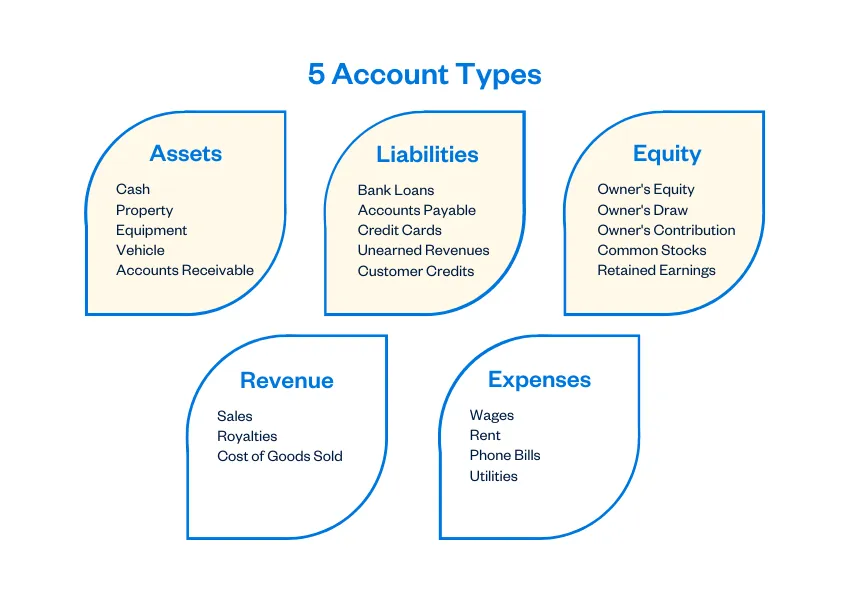

5 Different Types of Accounts in Accounting

What types of journal entries are tested on the CPA exam? - Universal CPA Review

Accounting for Investments in Debt and Equity Securities

What is the journal entry to record a foreign exchange transaction

Simplifying ARO's with a 4-step Approach + Journal Entries (FAR

Financial Accounting A Managerial Perspective 1259004880

20 Best Accounting Books of All Time - BookAuthority

Work with Journal Entries with Foreign Currency